Accounts Payable: Definition, Process and Example

Accounts Payable (AP) operations play a crucial role in managing a company’s financial health. Handling the timely and accurate processing of vendor invoices, payments, and other financial obligations is essential for maintaining strong relationships with suppliers and ensuring smooth business operations. However, businesses often face the decision of whether to retain or outsource their AP operations. In this article, we will delve into the intricacies of Accounts Payable, explore the benefits and drawbacks of both retaining and outsourcing AP operations, and provide insights to help businesses make an informed decision.

What is Accounts Payable?

Accounts Payable (AP) is a financial term used in accounting to refer to the money a company owes to its suppliers or vendors for goods and services that have been received but not yet paid for. In other words, it represents the outstanding balances a company owes to its creditors for various business-related transactions.

When a company receives goods or services from a supplier, the supplier sends an invoice detailing the amount owed and the terms of payment. The company records this invoice as a liability in its accounts payable account. The company is obligated to pay this amount to the supplier within the agreed-upon payment terms, which could range from a few days to several weeks or months.

Accounts payable is an important component of a company’s working capital management. Proper management of accounts payable involves effectively tracking and managing the payment obligations to ensure that the company maintains good relationships with its suppliers while also optimizing its cash flow. Companies often negotiate payment terms with suppliers to strike a balance between maintaining strong supplier relationships and managing their own cash flow efficiently.

In accounting terms, accounts payable is recorded as a current liability on the company’s balance sheet, reflecting the short-term nature of these obligations. As payments are made to suppliers, the accounts payable balance decreases, and the corresponding cash account is reduced.

In summary, accounts payable represents the unpaid balances a company owes to its suppliers or vendors and is a critical aspect of managing a company’s financial obligations and maintaining positive relationships within its supply chain.

How Does the Accounts Payable Process Work?

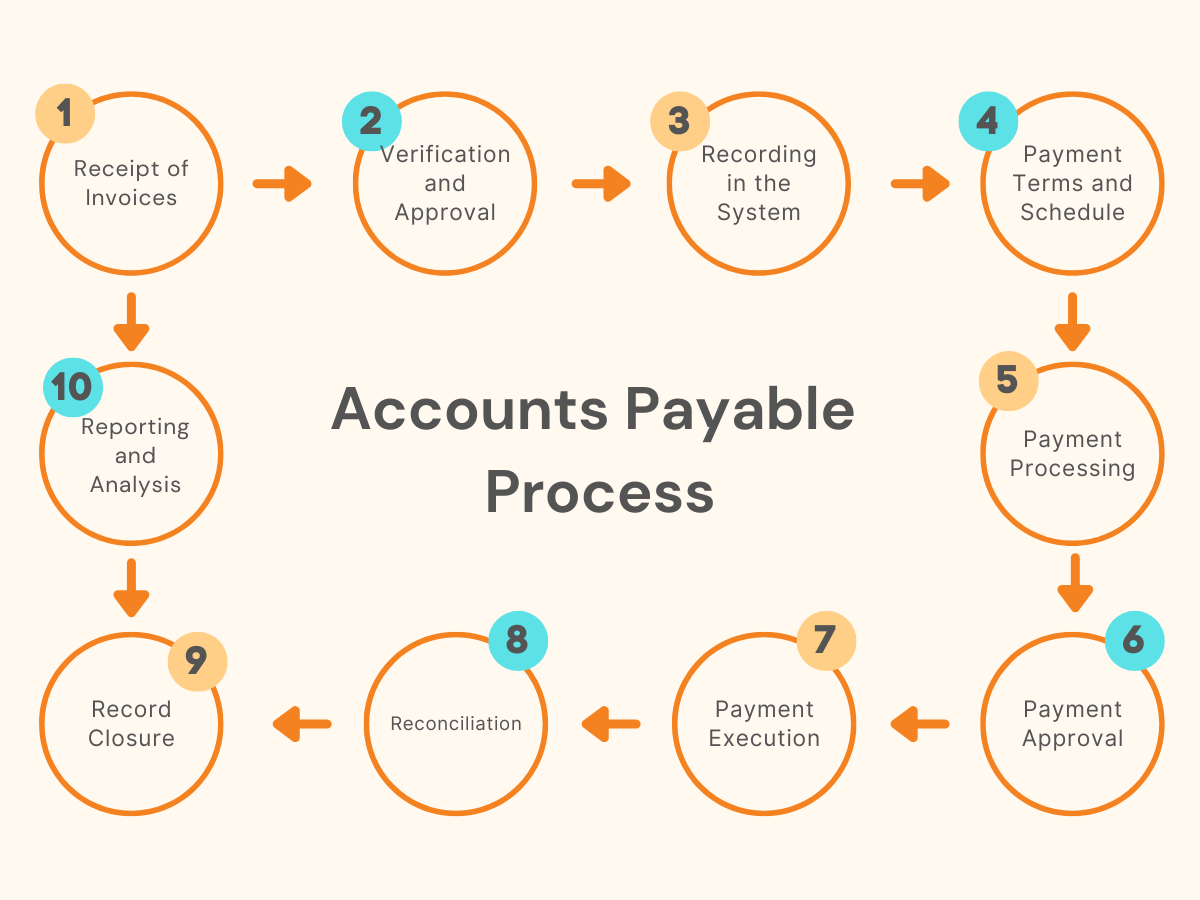

The Accounts Payable (AP) process is a crucial component of financial operations for any organization. It involves managing the payment of outstanding invoices and other financial obligations to vendors, suppliers, and creditors. Here’s a step-by-step overview of how the Accounts Payable process typically works:

1. Receipt of Invoices

The process begins when the company receives invoices from vendors for goods or services provided. These invoices outline the details of the transaction, including the amount owed, payment terms, due date, and any relevant purchase order or reference numbers.

2. Verification and Approval

The invoices are then reviewed for accuracy and legitimacy. The Accounts Payable department ensures that the goods or services were indeed received, and the prices and quantities match the agreement. Depending on the company’s internal procedures, invoices may require approval from relevant departments or managers before proceeding.

3. Recording in the System

Once invoices are approved, they are recorded in the company’s accounting system. The appropriate expense account is debited, and the Accounts Payable account is credited, reflecting the company’s liability to the vendor.

4. Payment Terms and Schedule

Payment terms specified in the invoice dictate when the payment is due. Common terms include “Net 30,” which means payment is due within 30 days of the invoice date. The Accounts Payable team tracks payment schedules and due dates to ensure timely payments.

5. Payment Processing

As the due date approaches, the Accounts Payable team prepares for payment processing. Depending on the company’s practices, payments can be made through checks, electronic funds transfers (EFT), credit cards, or other methods. Payment processing also involves verifying that the vendor’s details and bank information are accurate.

6. Payment Approval

Before payments are finalized, they may require a final approval step. This can involve managers or individuals responsible for financial oversight. Once approved, the payment is ready for execution.

7. Payment Execution

Payments are executed on or before the due date. In the case of electronic payments, the Accounts Payable team initiates the transfer of funds to the vendor’s bank account. For checks, physical checks are issued and sent to the vendor.

8. Reconciliation

After payments are made, the Accounts Payable team reconciles the transactions to ensure that the correct amounts were paid and the vendor’s account is accurately updated. Any discrepancies or issues are addressed promptly.

9. Record Closure

Once payments are made and reconciled, the Accounts Payable system updates the vendor’s account to reflect the payment. The transaction is closed, and the vendor’s invoice is marked as paid.

10. Reporting and Analysis

Throughout the process, data related to Accounts Payable is collected. This data is used for financial reporting and analysis, helping the company monitor its cash flow, vendor relationships, and overall financial health.

The Accounts Payable process involves multiple steps, coordination among various departments, and adherence to financial controls to ensure accurate and timely payment of obligations. Efficient management of this process contributes to maintaining positive vendor relationships, managing cash flow, and maintaining financial accuracy.

Recording Accounts Payable

Recording Accounts Payable is an essential aspect of accurate financial accounting. It involves documenting the company’s outstanding obligations to vendors or suppliers for goods and services that have been received but not yet paid for. This helps in maintaining an accurate representation of the company’s liabilities on its balance sheet.

Example: ABC Furniture Company

On January 10th, ABC Furniture Company purchases $5,000 worth of wooden materials from Wood Suppliers Inc. The terms of the purchase dictate that ABC Furniture Company has 30 days to make the payment.

1. Purchase of Goods:

- On January 10th, ABC Furniture Company acquires wooden materials from Wood Suppliers Inc. for $5,000.

2. Invoice Received:

- On January 15th, Wood Suppliers Inc. sends an invoice to ABC Furniture Company detailing the purchase of $5,000.

3. Recording the Accounts Payable:

ABC Furniture Company records the transaction in their accounting system. They credit (increase) their Accounts Payable account and debit (increase) their Inventory or Materials account, depending on the nature of the purchase. In this case, they will debit their “Inventory” account.

Entry:

- Debit: Inventory $5,000

- Credit: Accounts Payable $5,000

This entry signifies that ABC Furniture Company owes $5,000 to Wood Suppliers Inc., which is recorded as an increase in their Accounts Payable. Simultaneously, the purchase of $5,000 worth of wooden materials is recorded as an increase in their Inventory account.

4. Payment of Invoice:

Let’s say, on February 9th, ABC Furniture Company makes the payment to Wood Suppliers Inc. to settle the outstanding invoice.

5. Recording the Payment:

When the payment is made, ABC Furniture Company records the transaction in their accounting system. They debit (reduce) their Accounts Payable account and credit (reduce) their Cash account.

Entry:

- Debit: Accounts Payable $5,000

- Credit: Cash $5,000

This entry indicates that ABC Furniture Company has paid off their $5,000 debt to Wood Suppliers Inc., reducing their Accounts Payable. The Cash account is also reduced by $5,000 to reflect the cash outflow.

At any given time, a corporation may have several open payments due to vendors. All outstanding vendor payments are noted in accounts payable. As a result, anyone looking at the accounts payable balance will see the total amount owed by the company to all of its vendors and short-term lenders. This total is shown on the balance sheet.

Recording Accounts Payable accurately helps companies manage their financial commitments, track expenses, and uphold transparent financial records. It aids in analyzing cash flow, making informed decisions, and maintaining good relationships with suppliers.

Accounts Payable and Trade Payables

Accounts Payable and Trade Payables are related terms in accounting that refer to the same concept: the amount of money a business owes to its creditors for goods or services received on credit. However, there can be a slight difference in how they are used or interpreted in various contexts.

Accounts Payable

Accounts Payable (AP) is a broader term that encompasses all the outstanding debts and obligations a company has to its suppliers, vendors, or creditors. It includes not only trade payables but also other types of liabilities such as accrued expenses, short-term loans, and other financial obligations. Accounts Payable is typically listed on the balance sheet as a liability, representing the total amount the company owes to various parties.

Trade Payables

Trade Payables specifically refer to the amount of money a business owes to its suppliers or vendors for goods and services acquired in the normal course of business. These are the short-term obligations arising from the purchase of inventory, raw materials, or other goods needed for the company’s operations. Trade Payables are a subset of Accounts Payable and focus solely on the trade-related transactions.

In essence, while the terms are sometimes used interchangeably, “Accounts Payable” is a more comprehensive term that covers all kinds of obligations, whereas “Trade Payables” is more specific and pertains only to debts resulting from purchases made as part of the core business operations.

Example: XYZ Electronics

XYZ Electronics, a technology company, provides a practical example to illustrate the difference between Accounts Payable and Trade Payables.

On January 1st, XYZ Electronics purchases electronic components worth $10,000 from TechParts Inc. They also take out a short-term loan of $5,000 from QuickLoans Corp. for operational expenses.

1. Purchase of Goods (Trade Payables):

XYZ Electronics acquires electronic components worth $10,000 from TechParts Inc. This amount represents a trade payable since it directly relates to the company’s core business activities.

2. Short-Term Loan (Accounts Payable):

The $5,000 borrowed from QuickLoans Corp. falls under Accounts Payable, as it’s a short-term liability to be repaid to a creditor, even though it’s not directly related to trade operations.

3. Recording Accounts Payable and Trade Payables:

- In XYZ Electronics’ accounting records:

- For the electronic components purchase:

- Debit: Inventory (or Cost of Goods Sold) $10,000

- Credit: Accounts Payable (Trade Payables) $10,000

- For the short-term loan:

- Debit: Operating Expenses $5,000 (or the relevant expense account)

- Credit: Accounts Payable (Short-Term Loan) $5,000

- For the electronic components purchase:

In this example, the electronic components purchase falls under Trade Payables and is recorded as part of Accounts Payable. The short-term loan is also recorded under Accounts Payable but doesn’t fall under Trade Payables as it’s not directly tied to business operations. The distinction between these terms is important for accurate financial reporting and analysis.

To sum up, Accounts Payable encompasses all liabilities owed by a company, including trade payables. Trade Payables, on the other hand, are a subset of Accounts Payable and deal specifically with obligations arising from business-related purchases.

Accounts Payable vs. Accounts Receivable

Accounts Payable

Accounts Payable (AP) is the amount of money a business owes to its creditors, vendors, and suppliers for goods or services that have been received but not yet paid for. It represents the company’s liabilities and is recorded on the balance sheet as a current liability. Accounts Payable typically includes obligations related to purchases of goods, services, and other short-term financial obligations.

Accounts Receivable

Accounts Receivable (AR) is the amount of money owed to a business by its customers or clients for goods or services that have been provided but not yet paid for. It represents the company’s assets and is recorded on the balance sheet as a current asset. Accounts Receivable reflects the company’s expectation of incoming cash flow from its customers.

Key Differences

1. Nature:

- Accounts Payable: Represents the company’s debts and obligations to external parties.

- Accounts Receivable: Represents the company’s expected receipts from its customers.

2. Direction:

- Accounts Payable: Money owed by the company to others (liability).

- Accounts Receivable: Money owed to the company by others (asset).

3. Balance Sheet Impact:

- Accounts Payable: Increases liabilities on the balance sheet.

- Accounts Receivable: Increases assets on the balance sheet.

4. Type of Transaction:

- Accounts Payable: Relates to purchases of goods and services on credit.

- Accounts Receivable: Relates to sales of goods and services on credit.

Example: XYZ Company

Let’s consider XYZ Company, a manufacturer of electronics:

1. Accounts Payable Example:

- On January 15th, XYZ Company purchases electronic components worth $10,000 from TechParts Inc. The components are received, but payment terms allow for payment in 30 days.

2. Accounts Receivable Example:

- On January 20th, XYZ Company sells electronics worth $15,000 to Retail Electronics Store. The payment terms allow the store to pay in 60 days.

3. For Accounts Payable:

- Debit: Inventory (or relevant expense account) $10,000

- Credit: Accounts Payable $10,000

4. For Accounts Receivable:

- Debit: Accounts Receivable $15,000

- Credit: Sales (or relevant revenue account) $15,000

In the above examples, the purchase of components leads to an increase in Accounts Payable, representing the company’s liability. The sale of electronics results in an increase in Accounts Receivable, reflecting the company’s expected incoming cash.

In summary, while Accounts Payable represents the company’s obligations to pay, Accounts Receivable represents the company’s expectation of receiving payments from its customers. Both are crucial aspects of a company’s financial management and are recorded on the balance sheet.

Automating Accounts Payable – A Glimpse into the Future

The digital revolution has ushered in a new era of efficiency and innovation, transforming traditional business processes. One such evolution is the automation of Accounts Payable (AP), a paradigm shift that brings enlightenment to financial operations.

In the past, managing Accounts Payable was often a labor-intensive and error-prone endeavor. The manual processing of invoices, data entry, and approval workflows consumed valuable time and resources. However, with the advent of automation, this landscape has undergone a remarkable transformation.

Accounts Payable automation harnesses the power of technology to streamline and optimize the entire payables cycle. This enlightened approach integrates cutting-edge software, artificial intelligence, and data analytics to revolutionize how businesses manage their financial obligations.

Consider the benefits: reduced human error, faster processing times, enhanced accuracy, and improved compliance. Automation not only expedites routine tasks but also empowers finance teams to focus on strategic decision-making and value-added activities.

Imagine invoices being captured digitally, with intelligent software seamlessly extracting key data for processing. Approval workflows are streamlined, ensuring swift reviews and minimizing delays. Payments are made with precision, eliminating the risks associated with manual data entry.

Furthermore, automation fosters transparency, providing real-time insights into the financial health of the organization. Reports and analytics unveil patterns and trends that enable informed decision-making. The audit trail becomes robust, promoting accountability and compliance.

Accounts Payable automation is a gateway to enhanced vendor relationships as well. Timely payments strengthen partnerships, while early payment discounts can be effortlessly availed, bolstering cost savings.

As we stand on the threshold of this enlightened age, embracing Accounts Payable automation is not merely a choice; it’s a strategic imperative. The old adage “time is money” resonates more than ever as automation liberates time and resources for value-driven endeavors.

In this age of transformation, businesses that grasp the potential of Accounts Payable automation seize the opportunity to transcend operational constraints and step into a realm of enlightenment, efficiency, and innovation.

Read more: ChatGPT in Accounting: How ChatGPT Transforms Accounting for Businesses

The Bottom Line

Accounts payable (AP) pertain to the liabilities amassed by a company throughout its activities that remain outstanding and require settlement in the near future. Consequently, AP is presented on the balance sheet as a current liability. Common items encompassed within payables encompass supplier invoices, legal expenses, contractor disbursements, among others.

Read more: Accounts Payable Outsourcing Solutions: The Complete Guide