Full-Service Bookkeeping Explained: Everything Your Business Needs

In today’s dynamic business environment, maintaining accurate and timely financial records is crucial for success. Full-service bookkeeping offers a comprehensive solution, handling all aspects of financial record-keeping, compliance, and reporting. This article delves into the intricacies of full-service bookkeeping, its benefits, and how outsourcing these services can be a game-changer for your business.

What Is Full-Service Bookkeeping?

Full-service bookkeeping encompasses a wide range of financial tasks beyond basic record-keeping. It involves managing all financial transactions, ensuring compliance with tax laws, generating financial reports, and providing strategic financial insights. This holistic approach ensures that every financial aspect of your business is meticulously handled, allowing you to focus on growth and operations.

Core Components of Full-Service Bookkeeping

Full-service bookkeeping goes far beyond tracking basic income and expenses. It is a comprehensive solution that provides accurate financial oversight, ensures compliance, and delivers the insights businesses need to grow. Below is a detailed look at each critical component of a full-service bookkeeping package.

1. Transactions Categorization

Every business transaction—sales, expenses, refunds, or transfers—must be categorized according to your chart of accounts. This categorization ensures the integrity of your financial statements and simplifies year-end reporting and tax filing. Accurate categorization also enhances visibility into spending trends and revenue sources, allowing better financial decisions.

2. Bank Reconciliations

Bank reconciliation is the process of matching your accounting records with bank statements to identify discrepancies. This essential activity helps detect unauthorized transactions, reduces the risk of overdrafts, and ensures your books reflect real cash balances. Consistent reconciliation supports smoother audits and reliable reporting.

3. Credit Card Reconciliation

Just as important as bank reconciliation, this process ensures all business credit card transactions are accurately recorded and accounted for. It helps identify fraudulent or duplicate charges, ensures vendor payments are properly posted, and keeps expense tracking precise.

4. General Ledger Reconciliation

The general ledger is the backbone of your accounting system. Full-service bookkeeping includes regularly reviewing and reconciling this ledger to identify and correct errors. This ensures your financial reports are built on accurate, up-to-date data and helps maintain internal controls.

5. Revenue Reconciliation with Bank Deposits

This step verifies that all revenue entries in your books match the actual deposits in your bank account. It’s crucial for spotting missed or duplicate payments, correcting entry errors, and maintaining trust in your income reports. It’s particularly useful for businesses with high transaction volumes or multiple sales channels.

6. Invoicing

Generating and managing invoices is a key part of maintaining healthy cash flow. A full-service bookkeeping team handles invoice creation, delivery, payment tracking, and reminders. This results in fewer missed payments and faster collections, reducing the burden on your internal staff.

7. Financial Statements and Reports

Accurate financial statements—such as income statements, balance sheets, and cash flow reports—are vital for understanding your business’s performance. Full-service bookkeeping includes preparing these reports monthly or quarterly to help business owners make informed decisions and track financial health over time.

8. Quarterly and Monthly Reporting

Regular reporting ensures your business remains financially transparent and compliant with local tax laws. Monthly and quarterly financial reports help spot trends, manage cash flow, and plan for the future with greater confidence.

9. Live Support

Access to qualified professionals who understand your specific accounting setup is essential. Live support enables you to get timely answers, resolve technical issues, and receive financial advice tailored to your business goals.

Add-On Services for Customized Bookkeeping

In addition to the standard components of full-service bookkeeping, many businesses benefit from customized add-on services. These offerings allow you to tailor your bookkeeping solution to meet your specific needs.

Monthly Sales Tax Processing

Stay compliant with all sales tax regulations by automating tax calculations, filings, and payments. This reduces the risk of penalties and ensures your sales tax is always up to date.

Payroll Reconciliations

Ensure that employee payroll entries align with your accounting records. Payroll reconciliation confirms that all withholdings, contributions, and tax payments are recorded correctly.

Accounts Payable Management

This service includes managing vendor bills, scheduling payments, and maintaining detailed records of all transactions. It helps you avoid late fees, optimize cash flow, and build strong supplier relationships.

Accounts Receivable Management

Managing incoming payments is crucial to cash flow. Full-service bookkeeping tracks invoices, sends follow-up reminders, and handles collections, reducing the number of overdue accounts.

Accounting Setup

For startups or businesses migrating to new accounting systems, professional setup ensures your chart of accounts, software integrations, and tax settings are properly configured from the beginning.

Report Customizing Package

Some businesses require financial reports tailored to their industry, investor requirements, or internal KPIs. Customized reporting ensures you get the insights you need in the format that works best for you.

Category Tracking

This allows you to track revenue and expenses by department, product line, or campaign. It’s particularly useful for budget planning, cost control, and performance analysis across different segments of the business.

Catch-Up Bookkeeping

Falling behind on your books can cause major compliance issues. Catch-up services bring your records up to date—whether you’re a few months or several years behind.

Clean-Up Bookkeeping

This service corrects historical errors, misclassifications, and inconsistent balances. It’s essential if your books are messy or you’ve switched accounting systems without proper migration.

Benefits of Full-Service Bookkeeping

1. Enhanced Accuracy and Compliance

Professional bookkeepers utilize standardized processes and advanced software to minimize errors, ensuring that financial records are accurate and compliant with regulations.

2. Time and Cost Efficiency

Outsourcing bookkeeping tasks frees up valuable time for business owners and staff, allowing them to focus on core activities. It also reduces the need for in-house accounting staff, leading to cost savings.

3. Strategic Financial Insights

Access to detailed financial reports and analysis enables informed decision-making, helping businesses identify opportunities for growth and areas for improvement.

4. Scalability

As your business grows, full-service bookkeeping can easily scale to accommodate increased transaction volumes and more complex financial needs.

5. Peace of Mind

Knowing that financial records are in expert hands provides peace of mind, reducing stress and allowing business owners to concentrate on strategic objectives.

Why Outsource Full-Service Bookkeeping?

Outsourcing full-service bookkeeping offers numerous advantages:

Access to Expertise: Benefit from the knowledge and experience of professional bookkeepers who stay updated with the latest financial regulations and best practices.

Advanced Technology: Outsourced services often utilize cutting-edge accounting software, providing real-time access to financial data and streamlined processes.

Cost Savings: Eliminate the expenses associated with hiring, training, and maintaining an in-house accounting team.

Flexibility: Outsourced bookkeeping services can be tailored to meet the specific needs of your business, offering flexibility as your requirements evolve.

Read more: Best Outsourced Bookkeeping Companies in Vietnam for CPA Firms

Why Choose Bestarion for Outsourced Accounting Services

At Bestarion, we specialize in providing comprehensive outsourced accounting services designed to meet the unique needs of businesses across various industries. Our services include:

Bookkeeping: Accurate recording and categorization of financial transactions.

Payroll Processing: Efficient management of employee compensation, tax withholdings, and benefits.

Tax Preparation: Ensuring compliance with tax regulations and timely submission of tax returns.

Our team of experienced professionals leverages advanced accounting software to deliver accurate, timely, and insightful financial information. By partnering with Bestarion, you can focus on growing your business while we handle the complexities of financial management.

For more information about our services, visit our website: Bestarion Outsourced Accounting Services

Flexible Pricing and a Free Trial: Explore Our Bookkeeping Solutions Risk-Free

At Bestarion, we understand that every business has unique financial needs. That’s why we offer two flexible pricing models to ensure you get the most value from our services:

Value-Based Pricing

This option is ideal for businesses looking for predictable monthly costs. We evaluate the complexity and volume of your bookkeeping tasks and offer a custom fixed monthly rate. You get a clear scope of work and consistent support, with no surprises.

Hourly Rate Pricing

Perfect for businesses with fluctuating or project-based bookkeeping needs. You pay only for the time spent on your tasks, giving you the flexibility to scale up or down as needed.

Free Trial: 3 Books On Us

Not ready to commit? Try our bookkeeping services risk-free. We offer a free trial covering up to three books, so you can experience the quality, accuracy, and professionalism of our team before making any decisions.

Get an Instant Cost

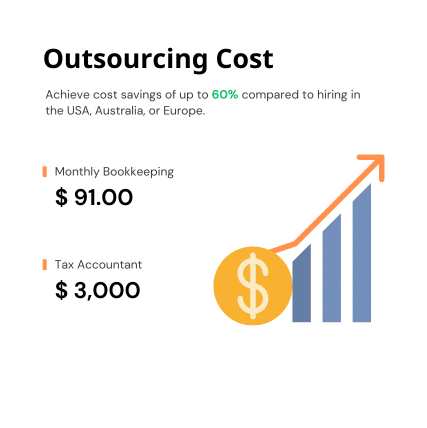

Calculate Your Accounting Outsourcing Cost Savings

Save up to 60% on staffing costs for CPA firms while accessing top-notch bookkeeping and accounting expertise—fast, reliable, and cost-effective!

Use Our Instant Quoting Calculator

You can estimate your outsourcing costs in seconds using our interactive quoting calculator. Just enter your business requirements, and we’ll provide an instant, transparent quote—no emails, no calls, no waiting.

Conclusion

Full-service bookkeeping is an indispensable component of successful business operations, providing comprehensive financial management that enhances accuracy, compliance, and strategic planning. Outsourcing these services to professionals like Bestarion offers numerous benefits, including cost savings, access to expertise, and the freedom to focus on core business activities. Investing in full-service bookkeeping is not just a financial decision; it’s a strategic move towards sustainable growth and success.

Read more: Why You Should Hire Offshore Accountants in Vietnam: Costs and Best Practices

Bestarion Website Admin