The Cost of Outsourced Bookkeeping Services for Your CPA Firm

Outsourcing has become increasingly popular for businesses looking to streamline operations and reduce costs. In the realm of accounting, outsourcing bookkeeping tasks to external service providers, has emerged as a viable solution for many CPA Firms.

Outsourced bookkeeping services cost up to $100 per hour or $500 to $5,000 monthly for your accounting firm. Several aspects must be considered when estimating the cost of outsourcing your firm’s compliance tasks. While this may appear intimidating or overwhelming, be assured that your potential outsourcing provider navigates these waters daily and is skilled at making the process clearer and more seamless.

Maintaining accurate and timely bookkeeping requires ongoing attention. Your primary focus as a CPA should be on high-value, strategic tasks such as negotiating financial complexity, providing consulting services, and promoting business growth. However, the mundane but necessary bookkeeping task can frequently consume significant time and resources. One critical decision is whether to use or keep outsourced bookkeeping services in-house.

By leveraging the expertise of professional bookkeepers, businesses can focus on their core competencies while ensuring accurate and efficient financial management. However, it is crucial to understand the costs involved before deciding to outsource bookkeeping services. In this article, we will explore the factors that influence the cost of outsourcing your CPA firm’s bookkeeping and provide insights to help you make an informed choice.

Read more: A Complete Guide to Bookkeeping for Small Business in 2023

Factors Influencing the Cost of Outsourcing Bookkeeping

Several factors come into play when determining the cost of outsourced bookkeeping for your CPA firm. These include your firm’s revenue, headcount, the specific services you desire, your industry, and the staffing method of your outsourcing provider.

Understanding these factors will allow you to evaluate the financial implications accurately. Let’s delve into the key elements that influence the cost:

- Volume or Number of Transactions: The book or number of transactions must be handled as a crucial driver of the cost of outsourced bookkeeping services. The price rises in tandem with the complexity and volume of transactions.

- Range of Services: The range of services required by the business can significantly impact the cost. Examples of services include general bookkeeping, vendor invoicing, credit card transactions, bank/credit card reconciliations, payroll, customer invoices, customer payment processing, and collections. Naturally, greater services imply a larger price.

- Revenue and Headcount: In particular industries, a company’s revenue and headcount can substantially impact the cost of outsourcing. The more income a company makes, the more work, the accounting team must do. Similarly, larger organizations may have more complex accounting requirements.

- Industry: The industry in which a company works can also affect the cost of outsourcing. Accounting standards, difficulties, and restrictions vary by sector. Professional services, for example, must comprehend task costing, whereas e-commerce enterprises must use inventory-based accounting.

- Staffing Method: Your price may be determined by the location and composition of your team. Outsourcing can be done onshore, offshore, or a combination. An onshore team often costs more than an offshore team. Still, a hybrid strategy can benefit both while alleviating most outsourcing worries. In most cases, this is the most cost-effective option.

- Level of Expertise and Experience:The expertise and experience of the bookkeeping professionals employed by the outsourced accounting provider can impact the cost. Higher expertise, certifications, and industry knowledge may command higher fees. However, it is essential to remember that opting for professionals with advanced skills can provide significant value by ensuring accuracy and compliance with accounting regulations.

- Geographic Location: Geographic location can also influence the cost of outsourcing bookkeeping services. Rates vary depending on the regional market and the cost of living in a particular area. For instance, outsourcing to providers in developed countries may be more expensive than outsourcing to developing countries.

Read more: Top 10 Bookkeeping Tips for Small Businesses

Pricing Model

One of the key considerations when outsourcing bookkeeping for CPA firms in determining the cost. Pricing models play a crucial role in defining how the outsourcing provider charges for their services. Understanding the pricing models available can help CPA firms make informed decisions and choose the most cost-effective option. This article will explore standard pricing models for outsourcing bookkeeping services and discuss their advantages and considerations.

Model 1: Hourly Rates

Hourly rates are a widely used pricing model in the outsourcing industry. Under this model, the outsourcing provider charges hourly for the time spent on bookkeeping tasks. The rate can vary depending on factors such as the complexity of the work, the level of expertise required, and the provider’s geographic location.

Advantages:

- Flexibility: Hourly rates offer flexibility as they allow firms to pay only for the time spent on the work.

- Transparency: Hourly rates provide clarity as firms can track the time spent on each task and verify the accuracy of the charges.

Considerations:

- Cost uncertainty: Hourly rates can lead to cost uncertainty, as the total cost may vary depending on the time taken to complete the tasks.

- Communication and tracking: Effective communication and task tracking are essential to ensure accurate billing based on the time spent.

Model 2: Flat Fees

Flat fees, also known as fixed fees, provide a predetermined cost for a set range of bookkeeping services. The price is agreed upon upfront, usually based on the anticipated volume and complexity of the work.

Advantages:

- Predictability: Flat fees provide predictability, as firms know the exact cost they will incur for the specified services.

- Budgeting: Flat fees allow firms to budget their expenses accurately without worrying about hourly fluctuations.

Considerations:

- Scope limitations: Flat fees typically cover a predefined scope of services, and any additional work outside the agreed-upon scope may incur extra charges.

- Scope clarity: It is crucial to understand the services included in the flat fee to avoid any misunderstandings or unexpected costs.

Model 3: Hybrid Models

Some outsourcing providers offer hybrid pricing models that combine elements of both hourly rates and flat fees. For example, a firm may pay a fixed monthly payment for a specified set of services. At the same time, additional tasks or complex projects are billed separately based on hourly rates.

Advantages:

- Cost control: Hybrid models balance cost predictability and flexibility by offering a fixed fee for routine services while accommodating variable or ad-hoc requirements.

- Tailored solutions: Hybrid models allow firms to customize their pricing based on their specific needs, ensuring they pay for their required services.

Considerations:

- Clear agreements: It is crucial to have clear agreements and contracts to define the services covered by the fixed fee and the terms for additional work billed at hourly rates.

- Monitoring and communication: Firms need to closely monitor the additional tasks or projects to ensure transparency and avoid any surprises in billing.

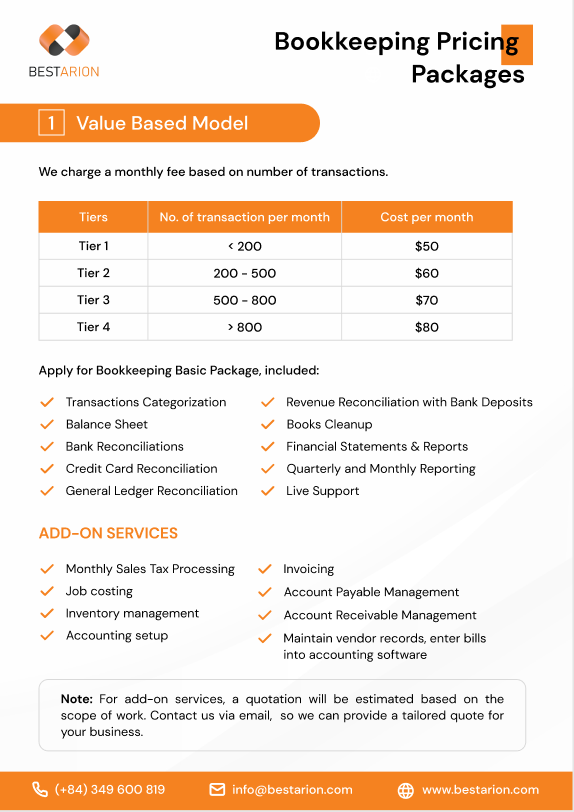

Model 4: Value-Based Model

The value-based model focuses on the value or impact the outsourced service brings to the business. Instead of basing the cost on time or tasks, the price is determined by the perceived value delivered to the client.

Advantages:

- Results-Oriented: The value-based model ensures that businesses pay for the actual value and outcomes achieved rather than the inputs or efforts.

- Strategic Partnership: This model fosters a collaborative and results-driven partnership between the business and the service provider.

- Performance Measurement: The value-based model allows businesses to evaluate the effectiveness of the service provider based on the value delivered and measurable impact on their business.

Considerations:

- Value Definition: Defining and agreeing upon the specific value metrics and outcomes is crucial for establishing a mutual understanding.

- Communication and Collaboration: Effective communication and collaboration are essential to align expectations and track progress toward value-based goals.

A broader industry survey suggested small businesses spend between $500 and $5,000 monthly on outsourced accounting and bookkeeping. Interestingly, the cost can also be approximated as about 1% of your firm’s revenue as it nears $1M, with the percentage generally decreasing as income surpasses $3M.

At Bestarion, we understand that different businesses have unique needs and preferences regarding pricing models for outsourcing services. We offer two flexible pricing options: Hourly Rate and Value-Based Model.

Benefits of Outsourced Bookkeeping Services

Outsourced bookkeeping services offer numerous benefits for businesses of all sizes. Here are some key advantages of opting for outsourced bookkeeping services:

Cost Savings

Outsourcing bookkeeping allows businesses to save costs for hiring and training in-house bookkeepers. By outsourcing, you can access a team of experienced professionals at a fraction of the cost of maintaining an in-house department. Additionally, you can eliminate expenses related to employee benefits, office space, equipment, and software.

Focus on Core Competencies

Bookkeeping is a critical function for businesses but is not typically their core competency. Outsourcing this task allows business owners and internal staff to focus on their primary responsibilities and strategic initiatives. By delegating bookkeeping to experts, you can allocate more time and resources to growing your business and serving your customers.

Expertise and Accuracy

Outsourced bookkeeping service providers specialize in financial management and have a team of skilled professionals with expertise in accounting principles and industry best practices. They stay up-to-date with the latest regulations and can ensure accuracy in financial records, including reconciliations, financial statements, and tax compliance. This expertise reduces the risk of errors, improves financial reporting, and provides a solid foundation for decision-making.

Scalability and Flexibility

Outsourced bookkeeping services offer scalability and flexibility to adapt to your business’s needs. Whether your company is experiencing rapid growth or seasonal fluctuations, outsourcing allows you to scale your bookkeeping resources up or down quickly. You can adjust the level of services based on your requirements, ensuring cost efficiency and avoiding the burden of hiring and training additional staff during peak periods.

Data Security and Confidentiality

Outsourcing bookkeeping to reputable service providers ensures data security and confidentiality. They employ robust security measures to protect your financial information, including encryption, secure servers, and access controls. Additionally, they adhere to strict privacy policies and confidentiality agreements, giving you peace of mind that your sensitive data is handled with utmost care and confidentiality.

Read more: 9 Best Bookkeeping Practices for Small Businesses

Wrapping Up

While the cost of outsourced bookkeeping services might vary extensively, evaluating the significant benefits it can bring your CPA practice is critical. You’ll have more time to focus on your main business tasks if you collaborate with a reliable bookkeeping outsourcing firm like Bestarion. You’ll also have access to a team of specialists that are up to date on the newest technologies and practices. Selecting the best bookkeeping outsourcing provider is an investment in your organization. It’s critical to pick a partner who fits your culture and knows your business requirements.

Choosing the best-outsourced bookkeeping services provider for your CPA practice is a big decision. The appropriate partner will be more than just a vendor; they will become an extension of your team, assisting you in scaling and succeeding in your company endeavors.

Regarding cost and pricing structures, it’s critical to consider what works best for your company’s demands and budget. The cost of outsourcing bookkeeping services varies substantially depending on the number of transactions, the variety of services required, your company’s income and headcount, your industry, and your staffing technique. Understanding these aspects and how they relate to your company’s specific demands is critical in developing a budget that works for you.

Pricing models can also have an impact on your selection. Hourly rates and fixed monthly costs are the two most frequent pricing systems. While hourly rates are common, they can often lead to inefficiency and unexpected bills. Fixed monthly pricing, on the other hand, can encourage billing efficiency and predictability, making it easier to arrange your finances. The majority of accounting teams choose set monthly charges. Still, it’s critical to identify which technique best corresponds with your firm’s financial and operational processes.

Finally, don’t just think about outsourcing as an expense. Consider it an investment in your company’s growth, efficiency, and overall success. When chosen carefully, an outsourced bookkeeping services provider can deliver considerably more value than they cost by freeing up your time, lowering overheads, and giving knowledge in areas you may need to have in-house.

Remember that choosing the correct partner is a strategic decision that can increase your firm’s efficiency, scalability, and success in the long run. Now that you’ve gathered this knowledge, it’s time to go on. Evaluate your firm’s demands, consider your budget, and begin your search for the best-outsourced bookkeeping services provider for your CPA firm. We are confident that your quest for the top bookkeeping services provider has ended with us.

Are you prepared to invest in the future of your company? Contact us today, so we can provide a tailored quote for your business.

Read more:

- Data Disclosure In Offshoring Bookkeeping Services: Should CPA Firms Worry?

- Top 4 Outsourced Bookkeeping Companies for CPA Firms in Vietnam