Discounted Cash Flow (DCF) Explained: Formula, Examples & How It Works

Discounted Cash Flow (DCF) analysis is a powerful valuation method used to estimate the value of an investment based on its expected future cash flows. It is widely used in finance for business valuation, investment decisions, and capital budgeting. This guide provides an in-depth explanation of the DCF method, its formula, and practical examples.

What is Discounted Cash Flow (DCF)?

DCF is a financial valuation method that determines the present value of an investment based on its projected future cash flows, discounted back to the present using an appropriate discount rate. The fundamental principle of DCF is that money received today is worth more than the same amount received in the future due to the time value of money (TVM).

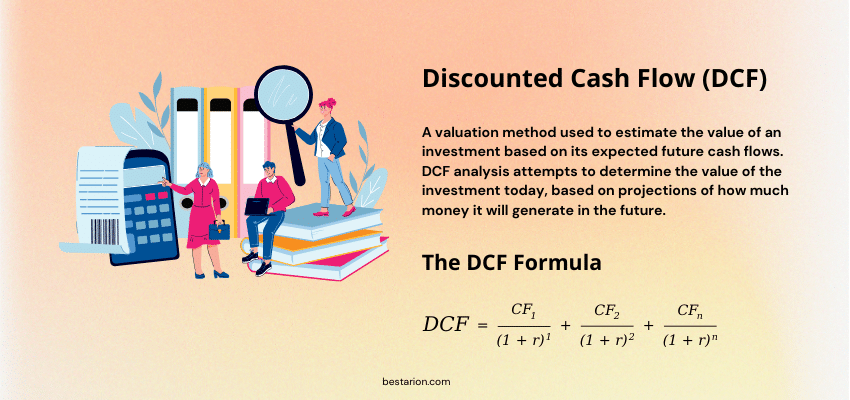

The DCF Formula

The basic formula for DCF is:

Where:

- \( \text{DCF} \) = Discounted Cash Flow

- \( \text{CF}_t \) = Cash flow in period \( t \)

- \( r \) = Discount rate (cost of capital or required rate of return)

- \( t \) = Time period (years, quarters, etc.)

- \( n \) = Total number of periods (years)

For a continuous stream of cash flows, the formula extends into an integral representation.

Steps to Perform a DCF Analysis

- Estimate Future Cash Flows: Identify and project the expected cash flows over the investment period.

- Choose a Discount Rate: Determine the discount rate, typically based on the Weighted Average Cost of Capital (WACC) or required rate of return.

- Discount the Future Cash Flows: Use the DCF formula to calculate the present value of each projected cash flow.

- Sum the Discounted Cash Flows: Add up all the discounted cash flows to arrive at the Net Present Value (NPV).

- Interpret the Result:

- If NPV > 0, the investment is considered profitable.

- If NPV < 0, the investment may not be worthwhile.

- If NPV = 0, the investment breaks even.

How Does Discounted Cash Flow (DCF) Work?

Discounted cash flow (DCF) analysis calculates the present value of expected future cash flows using a discount rate. This approach helps investors determine whether the future cash flows generated by an investment or project will exceed the initial investment cost. In simple terms, it assesses whether the money an investment is projected to generate in the future is worth more than the amount being invested today.

If the calculated value is higher than the initial investment, the project is considered financially viable. If not, it may not be a worthwhile investment.

DCF analysis is useful for estimating potential returns while accounting for the time value of money—the concept that a dollar today is worth more than a dollar received in the future because it can be invested to generate returns. This method applies to any situation where money is spent today with the expectation of earning more in the future.

For example, assuming a 6% annual interest rate, $100 in a fixed deposit account will grow to $106 in a year. Likewise, if a payment of $100 is delayed for a year, its present value is approximately $94.34 because it cannot be invested immediately to earn interest.

To perform a DCF analysis, an investor needs to estimate future cash flows and the potential final value of an asset, business, or investment. Additionally, selecting an appropriate discount rate is crucial, as it varies depending on factors like the investor’s risk tolerance, market conditions, and the nature of the project.

However, if future cash flows are difficult to predict or the project involves significant uncertainties, DCF analysis may not provide reliable insights.

Example of DCF Calculation

When a company considers investing in a new project or purchasing equipment, it typically uses its weighted average cost of capital (WACC) as the discount rate to perform a discounted cash flow (DCF) analysis. The WACC represents the expected rate of return that investors anticipate for that year.

For example, suppose a company plans to launch a new production line. The company’s WACC is 6%, meaning that a 6% discount rate will be used in the DCF calculation.

The initial investment required is $12 million, and the project is expected to generate cash flows over five years as follows:

Projected Cash Flow

| Year | Cash Flow |

|---|---|

| 1 | $1.5 million |

| 2 | $2 million |

| 3 | $3.5 million |

| 4 | $4 million |

| 5 | $5.5 million |

Applying the DCF formula, the discounted cash flows for each year are calculated as follows:

Discounted Cash Flow Calculation

| Year | Cash Flow | Discounted Cash Flow (nearest $) |

|---|---|---|

| 1 | $1.5 million | $1,415,094 |

| 2 | $2 million | $1,780,336 |

| 3 | $3.5 million | $2,941,791 |

| 4 | $4 million | $3,168,807 |

| 5 | $5.5 million | $4,125,452 |

Summing up all the discounted cash flows results in a total present value of $13,431,480. Subtracting the initial investment of $12 million, we obtain a net present value (NPV) of $1,431,480.

Since the NPV is positive, this suggests that the project could yield a return greater than the initial cost, making it a potentially profitable investment.

However, if the project had an initial cost of $14 million, the NPV would be – $568,520, indicating that the investment cost exceeds the projected returns, making it a less viable option.

Advantages of DCF Analysis

- DCF analysis helps investors and businesses determine whether an investment is financially viable by projecting future cash flows and their present value.

- It can be applied to various types of investments and capital projects, as long as future cash flows can be reasonably estimated.

- The model allows for adjustments to test different “what-if” scenarios, helping users evaluate multiple potential outcomes and make informed decisions.

Limitations of DCF Analysis

- A key drawback of DCF analysis is its reliance on estimates rather than actual figures. Since future cash flows and discount rates must be predicted, the accuracy of the results depends on the precision of these assumptions.

- Forecasting future cash flows involves uncertainty, as they are influenced by market demand, economic conditions, technological advancements, competition, and unforeseen risks or opportunities—many of which are difficult to quantify.

- While DCF is a valuable tool, it should not be used in isolation. Investors and companies should also consider alternative valuation methods, such as comparable company analysis and precedent transactions, to make well-rounded investment decisions.

Applications of DCF Analysis

- Business Valuation: Used by investors and analysts to determine the fair value of a company.

- Investment Decisions: Helps assess the profitability of projects or acquisitions.

- Capital Budgeting: Used by corporations to evaluate long-term investment opportunities.

- Real Estate Valuation: Applied in property investment to determine future value based on rental income.

Is Discounted Cash Flow (DCF) the Same as Net Present Value (NPV)?

Although DCF and NPV are closely related, they are not identical. NPV expands on the DCF calculation by adding an additional step.

The DCF process involves four main steps:

- Estimating future cash flows

- Choosing an appropriate discount rate

- Discounting the expected cash flows

- Summing the discounted values

NPV takes this a step further by subtracting the initial investment cost from the total discounted cash flows.

For example, if the total discounted cash flows from an investment amount to $248.68 and the initial investment cost is $200, the NPV would be:

NPV = $248.68 – $200 = $48.68

A positive NPV indicates that the investment is expected to generate more value than its cost, making it a potentially profitable opportunity.

Conclusion

DCF analysis is a fundamental tool for valuing investments based on projected future cash flows. While it has certain limitations, when used correctly, it provides valuable insights into the true worth of an investment. By carefully selecting the discount rate and making realistic cash flow projections, investors and businesses can make well-informed financial decisions.

By mastering DCF, you gain a deeper understanding of financial valuation, allowing you to assess investment opportunities with greater confidence.

Read more:

- Accounting Information System (AIS): Definition, Benefits and Components

- Balance Sheet: Explanation, Components, and Examples

- Outsourcing Finance and Accounting Services: The Complete Guide

Need Outsourced Accounting Services

For Your CPA Firm

Bestarion Website Admin