In today’s fast-paced and competitive global business landscape, companies are constantly seeking ways to optimize their operations, reduce costs, and enhance their strategic capabilities. One approach that has gained significant traction in recent years is Knowledge Process Outsourcing (KPO). This article delves into the growing importance of KPO, exploring its market dynamics, key drivers, challenges, […]

Top 10 Software Development Companies in Viet Nam 2025

The Information and Communications Technology (ICT) sector in Vietnam has grown at an average annual rate of 9.8% over the last five years, with annual revenue of $110 billion in 2019, accounting for 14% of the country’s GDP. It is increasingly rising as an outsourcing destination in the Asia-Pacific region, thanks to its growing IT […]

Why Does Software Development Outsourcing Fail?

Outsourcing software development has become a strategic necessity for many businesses looking to enhance their operational efficiency and reduce costs. However, the challenge lies not just in finding the right outsourcing partner but also in ensuring that the quality of the software meets your expectations. This article delves into the intricacies of outsourcing software development […]

Agile Software Development Outsourcing: The Key to Startup Growth and Innovation

In today’s fast-paced business landscape, startups often face numerous challenges and constraints that can impede their growth and success. One of the most significant hurdles they encounter is the need to develop high-quality software products quickly and cost-effectively. Agile software development outsourcing has emerged as a powerful solution for startups, offering a range of benefits […]

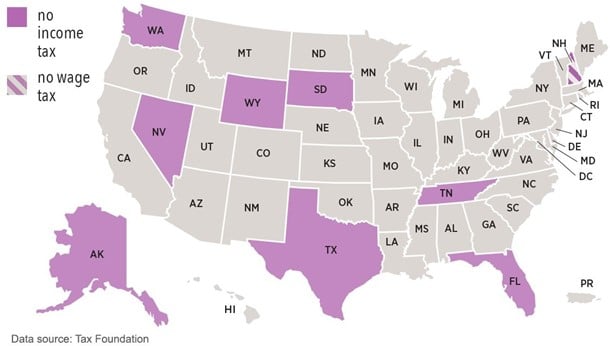

States With No Income Tax: The Best Places to Keep More of Your Money

One of the biggest financial concerns for Americans is how much of their income goes to taxes. While federal income tax is unavoidable, state income tax varies significantly across the U.S. In fact, some states have no income tax at all, making them attractive destinations for workers, retirees, and business owners looking to maximize their […]

Payroll Tax: Everything Employers and Employees Need to Know

Payroll tax is a fundamental aspect of employment that affects both employers and employees. Understanding payroll tax is crucial for compliance, accurate financial reporting, and effective business operations. In this guide, we’ll explore payroll tax essentials, including types, calculations, compliance requirements, and best practices for businesses. What is a Payroll Tax? A payroll tax is […]

Certified Public Accountant (CPA): Roles, Responsibilities, and Career Paths

What is a Certified Public Accountant (CPA)? A Certified Public Accountant (CPA) is a licensed accounting professional who has passed the Uniform CPA Exam, administered by a state’s Board of Accountancy. This designation signifies expertise in accounting, auditing, taxation, and financial management. The CPA exam is developed under the guidelines of The American Institute of […]

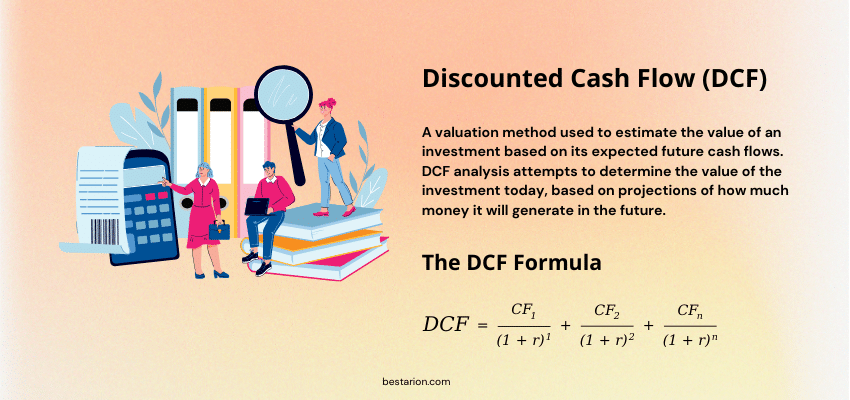

Discounted Cash Flow (DCF) Explained: Formula, Examples & How It Works

Discounted Cash Flow (DCF) analysis is a powerful valuation method used to estimate the value of an investment based on its expected future cash flows. It is widely used in finance for business valuation, investment decisions, and capital budgeting. This guide provides an in-depth explanation of the DCF method, its formula, and practical examples. What […]

Top 10 Business Intelligence (BI) and Analytics Trends for 2025

In a data-driven world, Business Intelligence (BI) and analytics have become strategic imperatives for organizations aiming to thrive in fast-changing markets. As we step into 2025, the convergence of AI, cloud computing, and real-time analytics is propelling BI far beyond traditional dashboards and reporting. Businesses are no longer just analyzing what has happened—they’re predicting what’s […]

Balance Sheet: Explanation, Components, and Examples

The balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is a crucial tool for investors, creditors, and analysts seeking to evaluate a company’s health and performance.