Latest Accounting Trends in 2023 | Future in Accounting

Accounting trends and techniques are constantly changing, especially as new technologies emerge. SAGE has found that 90% of accountants think accounting is going through a cultural shift that favors technology. This is because automation and high-tech systems are changing the future of accounting.

As you grow your accounting practices, outsourcing is the perfect way to decrease costs, increase efficiency, and boost profitability. Here are all the accounting trends you need to know to make the most of accounting outsourcing for your firm.

If we look at the future of accounting, technology may still be a few inches away from the accounting world. Still, it has already started to work and adapt to these new developments. We are moving quickly toward accounting trends like outsourcing finance and accounting services and advanced technical fixes like cloud-based subscriptions, on-premise solutions, and Software-as-a-Service (SaaS).

Latest Accounting Trends That Businesses Must Keep An Eye

So, let us look at the latest accounting trends that you must take note of:

1. Increased Use of Data Security

Accounting firms and their clients share more information electronically; they must protect themselves from cyber threats and other data security problems. One way to do this is to ensure their employees know data security.

Cloud-based software is a cheap and scalable way to store data online in a secure way. This makes it easier for accountants to get to work on the go or at home.

Accounting firms should also set up systems that require two forms of authentication so that only authorized users can get sensitive information because accountants and clients share so much confidential financial information.

Focusing on data security will help organizations protect their customers’ most valuable asset, their financial information.

2. Accounting in the Cloud

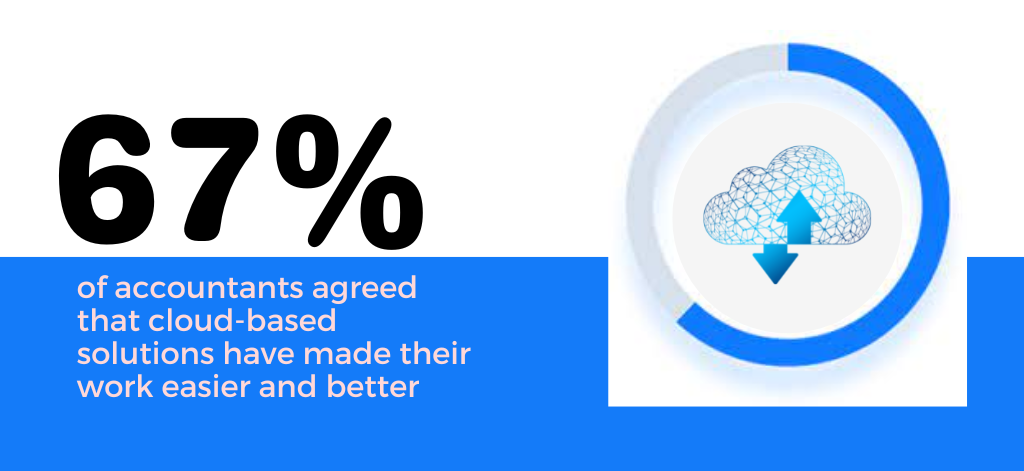

The cloud and accounting services are now two things that most businesses can only do with and is predicted to be one of the most applied accounting trends in 2023. Accounting systems hosted on the cloud have made it easy for many companies to access their digitally hosted system anytime and anywhere. There are many benefits of adopting cloud technology. Even the accountants agreed that cloud-based software is the need of the hour.

Source: The Practice of Now

“The Practice of Now” by Sage found that 67% of accountants agreed that cloud-based solutions have made their work easier and better.

In another report by Accounting Today, 58% of organizations noticed and accepted the benefits of moving to the cloud and are now using cloud-based accounting systems. This proves the importance of the cloud in accounting streams.

3. Accounting Trends: Increased Use of Financial Software

In this age of modernization and digitization, there is no doubt that the need for good financial software is growing. As a result, the market for business accounting software is expected to grow 6% per year from 2020 to 2024.

Technology is more important than ever if you want to keep up with the market and stay ahead of the competition. For example, SMEs can look into accounting and finance software that can help them right away with things like managing cash and spending, keeping track of billing and invoicing, and processing payroll.

Using accounting software increases accuracy by reducing errors. Software applications with advanced technology help generate financial analysis reports in a single click, assisting in effective decision-making. In addition, the entire data can be backed up in cloud storage, making it easier to recover during losses. Most finance and accounting outsourcing companies use software to increase productivity and accuracy.

4. Offshore Staffing with Remote Workplace

Finding the right people in finance and accounting is getting harder and harder. Because of this, it is even more critical for businesses to expand how they search for and hire candidates.

A poll was done that more than 80% of CPA firms plan to let employees start working from home even after the pandemic. Before, this wasn’t possible. As technology improves, accounting systems emerge, and accountants who work from home can do just as well as those who work in offices.

Look at the below stats:

|

Remote Work |

Hybrid Work |

| 40% of companies expect most of their employees to work at least part of the time remotely in the future.

(Source: SHRM) |

82% of companies plan to allow their employees to work at least part of the time remotely in the future.

(Source: Gartner) |

| 42% of companies plan to adopt a hybrid work model

(Source: PwC) |

42% of companies plan to adopt a hybrid work model

(Source: PwC) |

The 10th Annual Flex Jobs Survey, done from July to August 2021, found that 58% of respondents want to work full-time from home after the pandemic, while 39% want a hybrid work environment.

Because of this, top companies will get the best accountants. As a result, finance experts have started to use more advanced technologies to resolve problems and increase the firm’s profit.

And a classic example that comes to mind is a setting where people work from home. Most of us will agree that the costs have been cut by embracing remote work and digital accounting trends and techniques. Plus, it has made the whole progression better.

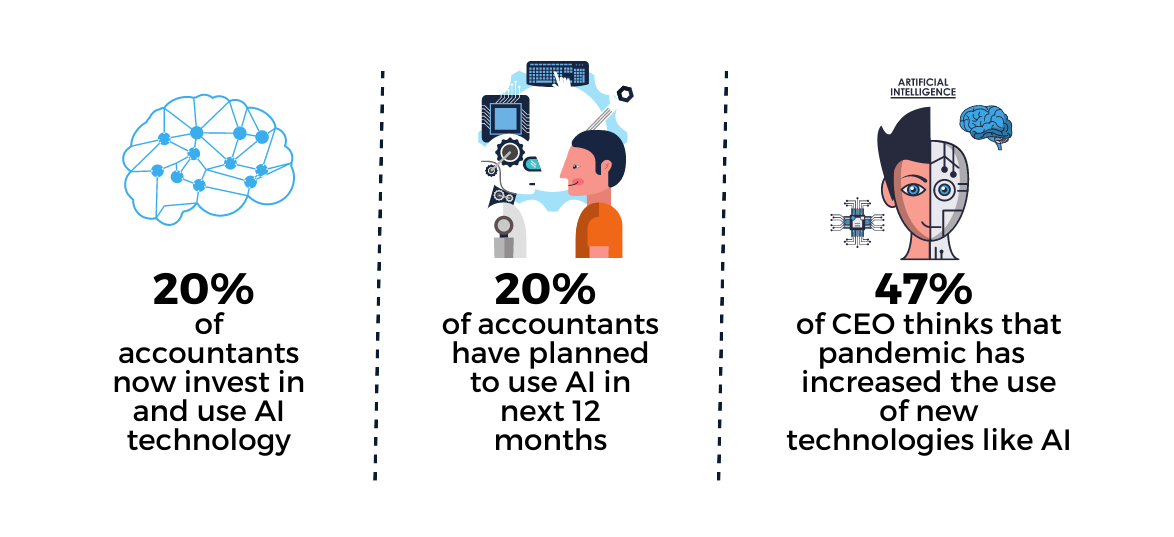

5. AI for Accounting

Accountants and Chief Information Officers (CIOs) agree that artificial intelligence software is one of the new technologies that will shape the industry’s future.

Source: KPMG

A survey by Harvey Nash/KPMG found that 20% of accountants now invest in and use AI technology. Another 20% said they planned to use AI within the next 12 months (Sage,2020).

On the other hand, 47%of CIOs think that the COVID-19 pandemic has sped up digital transformation and increased the use of new technologies like AI, machine learning, blockchain, and automation.

AI runs mostly on data, so businesses need to get good data. This will enable businesses to get accurate business intelligence, giving them an edge over their competitors.

6. Accounting Trends: Implementing Blockchain Technology

Blockchain technology is a distributed ledger that makes transactions safe and impossible to change. As a result, it will probably change how many businesses work.

Blockchain technology is already changing finance and accounting, making reconciling and maintaining ledgers cheaper. In addition, this technology will likely be used for audit trails, payments, and billing, reducing the need for banks and auditors to act as middlemen.

Statista thinks that by the end of 2023, U.S. companies will have spent around $1.1 billion on blockchain technology. In addition, the report mentioned that.

“The financial sector accounted for around 30 percent of the market value of blockchain worldwide in 2020.”

So, as the business appears differently, accountants need to know how technology works.

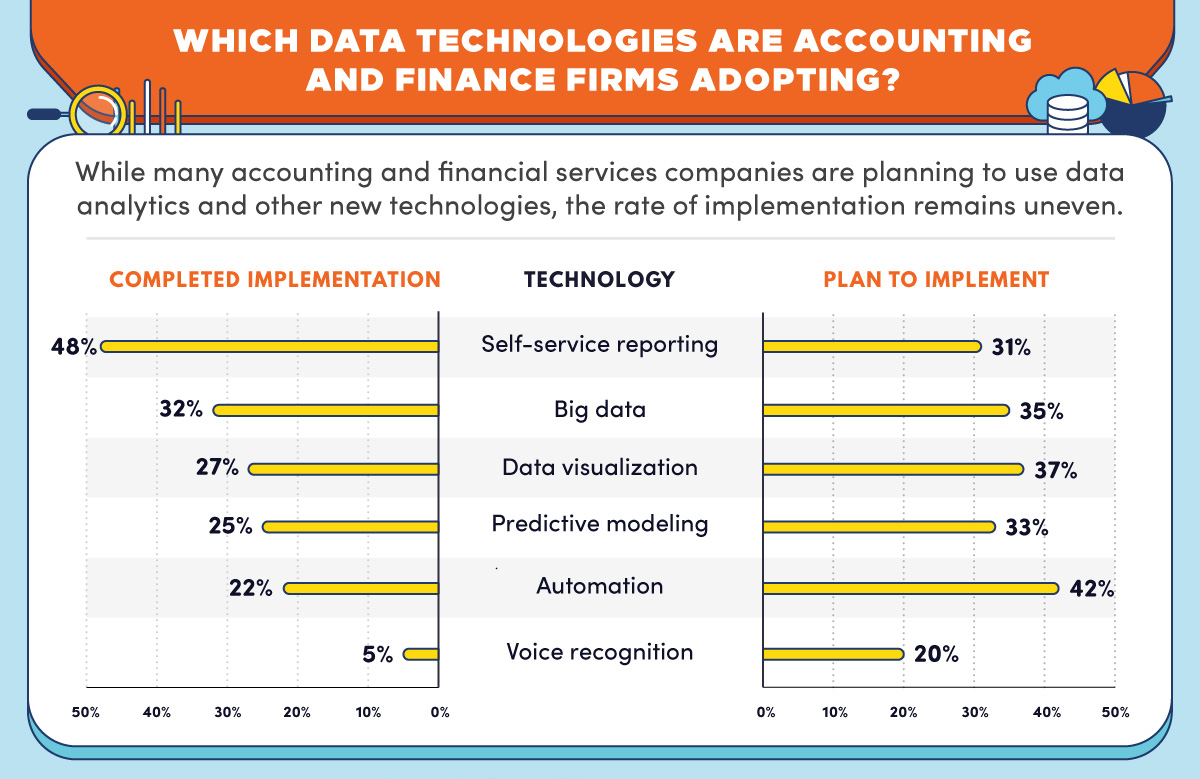

7. Increased Use of Data Analytics

In today’s fast-paced business world, trying new ways in finance and accounting is essential. With the rise of data analytics, accountants are asked to do more than report on finances.

Business owners want to know how to make more money, save, and provide better customer service. As a result, many accountants also act as advisors and consultants in these areas.

Source: Institute of Management Accountant

Data analytics leads to better and more efficient systems, which saves time and money. Accountants can better understand the process and suggest ways to cut costs and save time if they can look at financial results quickly.

Accountants can also use predictive data analytics to set prices and make better forecasts that help business owners know what to expect in the future. They must become more strategic and move toward projects to help their businesses run better and make more money.

8. Social Media will become an Enabler

Accounting and social media may seem like strange partners, but networking is essential to the success of almost every business. Even the most traditional people used social media to talk to potential clients post-pandemic. Likewise, social media sites help accounting firms build their reputations, get more people to visit their websites, and make new contacts. With social media, the accounting industry must catch up to the rest of the business world.

9. Accounting Trends: Taxes Can be Filed Online

If your finances could be better, you must spend much time on your tax calculations to ensure they are correct. However, you can automate your tax filing with online software and tools, keep track of your tax returns, and make bookkeeping services much easier.

One can figure out how to use these apps on your own or with the help of an accountant. In either case, filing taxes online is a valuable and easy way for small businesses and SMEs to get their taxes done. But, as with any technology solution, it’s essential to ensure that the person using these systems for a business knows how to use them properly and professionally. Outsourcing finance and accounting frees you from tax problems as they file your tax returns on time.

10. The Jobs of Accountants are Changing

The difference between finance and accounting has always overlapped, but as the accounting field becomes more focused on data analytics, more accountants are moving into advisory positions. In addition, accounting technology has improved so accountants can give their clients more accurate information.

One way accountants can keep from being entirely replaced by computers is by using the right technology to help businesses. Unlike other accounting tasks, making decisions will always be in the hands of experts and professionals.

11. Agile Accounting

Agile practices in software development are for implementing changes in software during development. Likewise, Agile Accounting is the process of adapting agile practices in accounting software to make changes in accounting at a rapid pace. Adapting to the changes on time and delivering practical accounting will increase customer satisfaction. It will be a marketing trend in 2023 to adopt agile accounting practices with accounting software.

Focusing on new accounting trends and implementing technology will pave the way for advanced accounting for increased profits. The data flow between the stakeholders will be continuous through effective communication, which reduces flaws in accounting and thus increases productivity. Outsourcing finance and accounting will allow you to access agile accounting.

12. Accounting Trends: Advisory Services

Besides accounting and financial services, outsourcing finance and accounting companies now provide advisory services to their clients. The need for advisory services has increased significantly due to organizations’ challenges, becoming one of the accounting trends in 2023. Experts’ suggestions and recommendations on accounting practices and financial strategies effectively resolve the challenges. With advisory services, organizations can improve their decision-making through analysis and future predictions. An Analysis of financial advisory and consulting services from Spend Edge reveals the market value increase will be $21 billion.

Financial advisory services help improve the business through strategic decision-making and timely responses. You can secure your business from various pitfalls by outsourcing accounting advisory services. It also helps businesses focus on core responsibilities rather than spending more time on financial activities.

Conclusion

More than ever, innovations and improvements are quickly moving the accounting field forward. From the view of accounting services and streamlined finance tasks, the above accounting trends are just some of what businesses should expect and consider enhancing in 2023 and beyond.

As a business owner, one of the most important things you can do to set your business up for growth and success is to use all the technology you can. Moving to a cloud-based automation system and outsourcing accounting services is the best thing you can do for your business. Contact Bestarion now to find out if our client accounting services could help your business grow faster.