AI in FinTech: 7 Ways AI is Transforming the FinTech Industry

Financial technology (FinTech) and Artificial Intelligence (AI) represent two cutting-edge innovations that have recently ushered in transformative changes within the financial sector. The potential of AI to drive economic growth by up to 26% and increase financial services revenue by an impressive 34% underscores its pivotal role in fueling the rapid advancement of FinTech. AI empowers financial institutions and businesses to efficiently analyze vast datasets, identify intricate patterns, and make data-driven decisions with precision and speed.

Within the realm of FinTech, artificial intelligence has given rise to groundbreaking products, including financial robo-advisors, algorithmic trading systems, fraud detection mechanisms, and personalized customer service platforms. As AI continues to evolve, its integration with FinTech promises to reshape the financial landscape, offering customers more tailored and responsive experiences. The advantages of AI in FinTech are instrumental in elevating the overall efficiency, security, and accessibility of financial services.

This article aims to delve into the profound impact of artificial intelligence on FinTech in the year 2023. Drawing upon the expertise of Bestarion, a company specializing in AI and machine learning development, we will delve into several critical facets, including the current market size of AI in FinTech, the seven transformative ways these technologies are revolutionizing the industry, and the future trajectory of AI within this sector. If you are in the process of assessing whether your FinTech project necessitates the incorporation of AI, this article will provide valuable insights into the significant value proposition of this technology.

Read more: 10 Remarkable Artificial Intelligence Applications in 2024

AI in the FinTech Industry Market Size

The market for AI in FinTech is anticipated to be worth $42.83 billion in 2023 and grow to $49.43 billion by 2028, with a CAGR of 2.91% over the forecast period (2023-2028). The market is categorized based on several critical factors, including type (solutions and services), deployment method (cloud and on-premise), application type (such as chatbots, credit scoring, quantitative and asset management, and fraud detection), and geography (North America, Europe, Asia-Pacific, and the Rest of the World).

Currently, the dominant segment within this market is the solution category, contributing to a substantial 77.5% of the global revenue. These solutions encompass various applications, including mobile banking, digital loans, insurance, credit scoring, buying and selling activities, and asset management. North America holds the foremost position in the AI in the Fintech market, primarily owing to the presence of prominent AI software and system vendors, substantial investments by financial institutions in AI initiatives, and the widespread integration of AI within Fintech solutions.

7 Ways AI is Transforming the FinTech Industry

Artificial intelligence has ushered in a seismic shift within the FinTech landscape, fundamentally reshaping conventional financial practices and paving the path for pioneering innovations. The integration of AI into FinTech is revolutionizing the sector, instilling greater efficiency, security, and inclusivity into the financial ecosystem, benefiting both businesses and customers alike. This section will elucidate seven critical avenues through which AI is poised to disrupt and redefine the FinTech landscape in 2023.

1. AI-Enhanced Customer Service and Engagement

In the realm of customer service, AI-driven chatbots and virtual assistants have emerged as transformative forces, elevating customer engagement and overall satisfaction. These AI-powered entities deliver instant, personalized customer support, adeptly handling routine queries, offering tailored product recommendations, and facilitating account management. What sets AI-powered client service apart is its round-the-clock availability, ensuring customers can access assistance at any hour.

Moreover, AI systems meticulously analyze customer data, deciphering preferences and behaviours. This wealth of insights equips FinTech companies to offer bespoke guidance and assist customers in making critical financial decisions. This highly personalized approach significantly augments the client experience and fosters organic business growth.

ChatGPT unveiled in 2022, stands out as one of the most potent chatbot technologies to date. Renowned for its natural conversational flow and adept handling of user queries, ChatGPT has rapidly gained popularity. Its developer, OpenAI, anticipates the technology to generate an astounding $1 billion in revenue by the end of 2023. Operating on a “pre-trained transformer language model,” ChatGPT employs “reinforcement learning from human feedback” (RLHF) techniques to produce human-like interactions, setting new standards in conversational AI.

2. Fortifying Cybersecurity and Fraud Detection

The surge in digital transactions and the proliferation of online financial services have given rise to an alarming increase in cyber threats and fraudulent activities. Within the realm of payments and FinTech, AI plays a pivotal role in bolstering cybersecurity measures and fortifying fraud detection capabilities. According to a Juniper Research analysis, businesses are projected to realize savings exceeding $10.4 billion by 2027 through the adoption of AI-powered fraud detection and prevention systems.

AI-driven algorithms possess the extraordinary capability to process vast quantities of data in real-time, maintaining a vigilant watch over transactions to discern patterns and detect anomalies. This continuous monitoring serves as an effective deterrent against potential security threats and vulnerabilities. These sophisticated AI systems adeptly differentiate between legitimate customer behaviours and suspicious activities, thwarting unauthorized access and potential financial losses.

The infusion of AI not only enhances security protocols to safeguard financial institutions and protect sensitive client data but also fosters enhanced trust among customers. By incorporating AI-driven predictive analytics into their fraud detection systems, financial enterprises can significantly curtail the incidence of false positives—transactions erroneously flagged as fraudulent.

Furthermore, financial service providers gain enhanced control over their data, facilitating more effective fraud detection and prevention. AI-powered large language models (LLMs) adeptly handle sensitive or confidential information within their infrastructure. This reduces reliance on third-party systems, mitigates privacy concerns, and ensures the security of delicate data.

3. Predictive Analysis

The success of financial organizations hinges mainly on their capacity to anticipate future challenges and assess prevailing business trends. Traditional predictive analysis models often grapple with limitations owing to the intricate and volatile nature of financial markets. Effectively predicting the future necessitates the adoption of more adaptive technologies for data consolidation, planning, budgeting, and scenario evaluation.

AI-powered predictive analytics harnesses the prowess of machine learning algorithms to discern patterns and trends within historical data, enabling more accurate forecasts. Through the integration of AI into predictive analysis, financial institutions are empowered to make informed decisions concerning investments, risk management, and market trends. This, in turn, translates into improved portfolio performance and enhanced risk mitigation strategies.

Large language models (LLMs) powered by AI prove invaluable in scrutinizing financial data and forecasting future investment trends, equipping investors with the insights needed to make reasonable decisions that optimize returns on investment. LLMs can undergo specialized training tailored to specific industries or sectors, customizing the model to yield precise results aligned with the nuances of the respective domain. This tailored approach ensures the delivery of highly targeted information, enabling more informed decision-making.

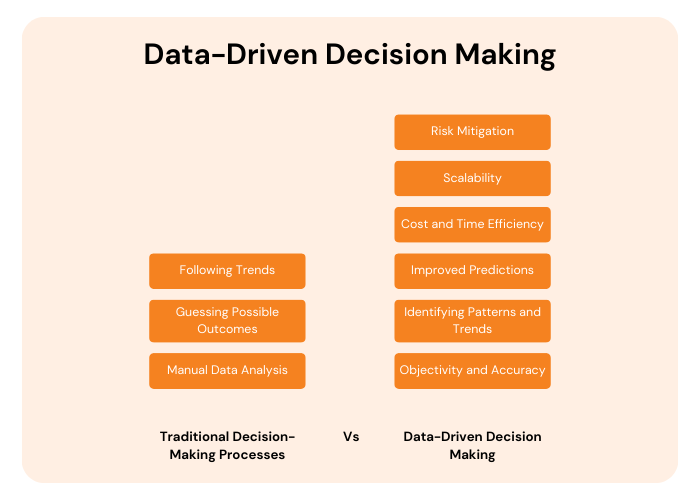

4. Data-Driven Decision-Making

Data-driven decision-making entails the use of concrete facts, metrics, and statistics to inform strategic business choices aligned with a company’s goals and initiatives. This approach offers several advantages over traditional decision-making processes:

- Objectivity and accuracy: Data-driven decisions rely on specific data and facts, reducing biases and subjectivity inherent in human decision-making.

- Pattern and Trend Identification: This method excels at uncovering patterns within vast datasets, unveiling valuable correlations that might remain hidden through traditional methods.

- Enhanced Predictions: Leveraging historical data and advanced algorithms, data-driven decision-making enables more accurate predictions about future events.

- Personalization and Customization: It can tap into individuals’ data to facilitate personalized experiences, bolstering customer satisfaction and loyalty.

- Cost and Time Efficiency: Streamlined decision-making reduces the time and effort required for analysis, enhancing efficiency and leading to cost savings and resource optimization.

- Scalability: This approach can be effectively scaled to handle large datasets and complex scenarios, adapting seamlessly to different business sizes and industries.

- Risk Mitigation: Data-driven decision-making identifies potential risks and vulnerabilities, enabling businesses to address challenges before they escalate proactively.

AI technologies play a pivotal role in extracting, analyzing, and utilizing data for informed decision-making, streamlining processes and reducing the time and effort required for traditional manual analysis. AI-powered systems process vast volumes of data from various sources, including social media, market trends, and consumer behaviour, to uncover relevant insights and opportunities.

For example, Large Language Models (LLMs) can analyze news and social media data to gauge public sentiment regarding financial products. Customized training using FinTech-specific datasets enhances their understanding of specialized topics, resulting in more accurate and contextually relevant responses compared to general-purpose language models.

FinTech companies can harness AI-driven insights to enhance their marketing strategies, tailor products and services to individual needs, optimize marketing plans, and develop cutting-edge solutions that cater to their customer’s unique demands, all facilitated by data-driven decision-making enabled by AI technologies.

5. Automated Virtual Personal Assistants

AI technology in the financial sector has paved the way for the development of automated virtual personal assistants, elevating the customer experience to new heights. These virtual assistants excel in handling a wide array of tasks, from providing real-time financial updates to executing transactions on behalf of customers. AI-powered assistant systems adeptly track bond and stock price trends and offer instantaneous advice to traders.

AI-driven robo-advisors introduce game-changing trading methods to both novice and experienced participants in the stock market. Beyond trading, financial assistants with AI capabilities extend their reach. Large Language Models (LLMs) can enhance financial literacy, assist in creating tailored financial plans based on spending patterns and financial goals, and promote sound financial decision-making.

Automated virtual assistants, bolstered by AI and natural language processing (NLP), revolutionize how businesses engage with their clients, enhancing overall customer experiences. They offer numerous advantages over traditional customer service approaches:

- 24/7 Availability: Automated virtual assistants operate round-the-clock without human intervention, ensuring customers receive prompt responses outside regular business hours.

- Instantaneous Responses: Virtual assistants manage multiple customer queries simultaneously and provide immediate responses, reducing wait times and offering swift resolutions.

- Cost-Effectiveness: Automated virtual assistants present a cost-effective solution compared to maintaining large customer service teams. Once set up, they require minimal maintenance and handle numerous interactions simultaneously.

- Consistency: Virtual assistants deliver consistent responses and service quality, ensuring uniform support for all customers regardless of the time of day or the agent handling the query. This fosters trust and credibility.

- Multilingual Support: Virtual assistants can be programmed to understand and respond in multiple languages, eliminating the need for language-specific agents.

- Personalization: Advanced virtual assistants analyze customer data and preferences to offer personalized recommendations and responses, making customers feel valued and understood.

- Learning and Improvement: AI-powered virtual assistants continuously learn from interactions, enhancing their responses and problem-solving capabilities. This iterative learning process ensures they become more proficient at addressing customer needs.

- Integration with Various Channels: Virtual assistants seamlessly integrate with multiple communication channels, including websites, mobile apps, and social media platforms.

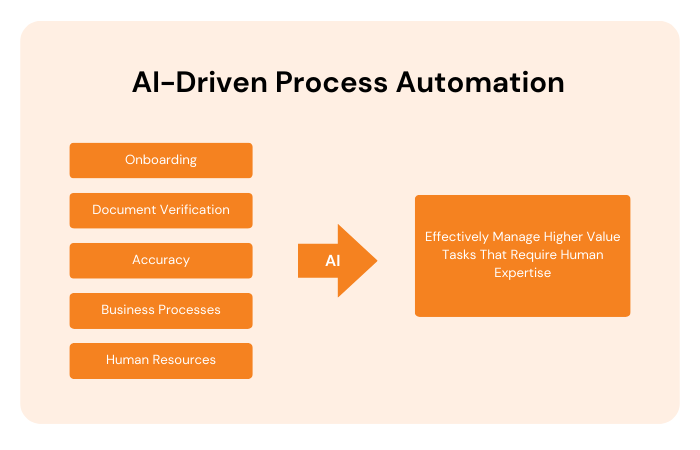

6. AI-Driven Process Streamlining

As per data from Mordor Intelligence, process automation emerges as a pivotal driver of AI adoption within financial institutions. In the realm of FinTech, AI technologies serve as catalysts for automating repetitive corporate procedures, effectively substituting manual labour and enhancing overall efficiency. AI-powered automation delivers streamlined operations while diminishing the need for extensive manual intervention.

The automation of tasks such as customer onboarding, document verification, and loan processing yields substantial time and cost savings for financial institutions. AI-driven automation is characterized by precision and compliance with regulatory mandates, ensuring heightened accuracy in these critical processes. Consequently, financial institutions can allocate their human resources more judiciously, focusing on higher-value tasks that necessitate human expertise.

AI-powered chatbots, exemplified by ChatGPT, play a pivotal role in enhancing business processes creating frameworks that teams can leverage to formulate comprehensive solutions. These chatbots are adept at offering structured financial investment proposals based on individual goals and priorities, analyzing customer feedback to gain deeper insights into client sentiments, or providing recommendations pertaining to new financial instruments and investment avenues.

Furthermore, large language models can expedite efficiency by summarizing extensive financial documents, including financial reports and contracts. Customization can tailor these models to adhere to specific response formats. AI-driven process automation finds applications across various domains, including sales, call center, accounting, and learning and development.

7. Creditworthiness Assessment Enhanced by AI

Conventional creditworthiness assessments primarily rely on historical financial data, offering a somewhat limited perspective on credit risk. In stark contrast, AI-driven creditworthiness analysis incorporates a more comprehensive array of factors, encompassing social behavior, online presence, and transaction history, thus delivering a holistic and precise credit risk assessment.

Financial institutions can harness AI’s prowess to efficiently analyze vast troves of consumer data, enabling precise credit evaluations. Modern AI systems scrutinize investment portfolios, cash flows, and credit accounts to gauge an individual’s financial well-being. By dissecting customer data, AI expedites account support and enables banks to remain attuned to real-time developments.

AI conducts comparisons and data analyses to determine customers’ eligibility for various products and services. Banking institutions can leverage large language models (LLMs) to scrutinize customer data and identify risk factors. Meanwhile, FinTech firms can tailor loan and insurance offerings to align with client profiles and specific needs.

The Future of AI in FinTech

The role of AI in FinTech is poised to revolutionize the sector by enhancing the speed, precision, and efficiency of financial services. Innovative AI solutions hold the potential to elevate consumer experiences, reduce costs, and propel the growth of FinTech companies. This section offers a glimpse into potential future developments and trends in the application of AI within the FinTech landscape.

Rapid Growth in Fraud Detection Enabled by AI

According to data from Mordor Intelligence, AI-driven fraud detection is primed for substantial growth in the near future. AI technologies empower swift and accurate identification of financial fraud and malpractice by processing massive datasets, delivering rapid computations, recognizing user behavior patterns, and detecting deviations in real time. AI is poised to reduce false positives, allowing specialists to focus on more intricate issues.

AI’s Influence on Elevating Customer Experiences

As per McKinsey’s research, customers will increasingly demand personalized and seamless experiences. Exceptional customer service and personalization are foundational to enhancing client satisfaction. AI-driven virtual assistants and chatbots are set to offer even more tailored guidance and round-the-clock customer service, resulting in heightened customer satisfaction and cost savings. AI will also leverage customer data to create individualized financial plans, promote products and services, and elevate overall customer experiences.

Enhanced Regulatory Compliance and Reporting

Financial Action Task Force research underscores the significant risks that FinTech poses to the financial system, encompassing money laundering, terrorism financing, financial crime, and fraud. AI is poised to streamline regulatory compliance and reporting processes in FinTech by automating data collection and analysis. Natural Language Processing (NLP) will interpret complex regulations, ensure transparency through audit trails, deliver timely regulatory alerts, and facilitate cross-border compliance.

Accelerating The Power of AI in FinTech with Bestarion

AI is a transformative force across industries, and the FinTech sector is no exception. It revolutionizes processes, enhances customer experiences, and fosters innovation. The seven ways discussed in this article merely scratch the surface of AI’s potential impact on finance and its capacity for future advancements. Staying ahead in the dynamic FinTech sector will necessitate embracing AI and its evolving applications.

If you’re keen on exploring the possibilities of AI within the financial industry, our outsourcing software development company stands ready to provide guidance and support. Bestarion can assist you in developing AI/ML solutions tailored to your business requirements and budget. We ensure data privacy through the implementation of appropriate Non-Disclosure Agreement (NDA) documentation.

Feel free to reach out to us for an in-depth consultation on how AI can revolutionize your FinTech endeavors.

Read more: AI in Education: Improving Education with Innovative AI