In today’s fast-paced business environment, efficiency and adaptability are essential for success. That’s where cloud-based accounting software comes into play—offering innovative solutions that allow businesses to manage their finances seamlessly and securely from anywhere in the world. This article explores various aspects of cloud-based accounting, including its benefits, how to use it effectively, comparisons with […]

Using AI in Accounting – Transforming Financial Management for the Future

In today’s fast-paced business environment, AI in accounting is transforming how organizations streamline their operations and improve efficiency. One of the most groundbreaking developments, it leverages advanced algorithms and machine learning to revolutionize financial management processes, reduce manual labor, and enhance decision-making capabilities. The Evolution of Accounting: From Traditional to AI-Driven Solutions The landscape of […]

Payroll Jobs Requirements – Your Essential Guide to Success

In the rapidly evolving world of finance and administration, understanding payroll jobs requirements is crucial for anyone looking to establish a successful career in this field. This article aims to explore the various facets of payroll jobs, including essential skills, qualifications, and resources needed to excel in this vital profession. Understanding Payroll Jobs: Overview and […]

Certified Public Accountant (CPA): Roles, Responsibilities, and Career Paths

What is a Certified Public Accountant (CPA)? A Certified Public Accountant (CPA) is a licensed accounting professional who has passed the Uniform CPA Exam, administered by a state’s Board of Accountancy. This designation signifies expertise in accounting, auditing, taxation, and financial management. The CPA exam is developed under the guidelines of The American Institute of […]

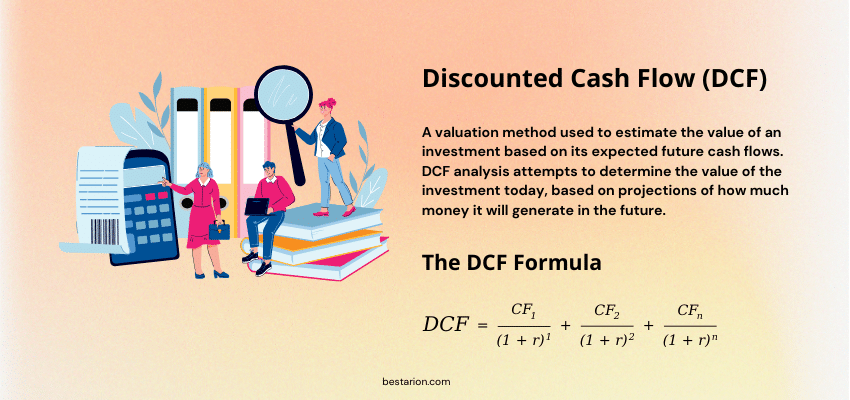

Discounted Cash Flow (DCF) Explained: Formula, Examples & How It Works

Discounted Cash Flow (DCF) analysis is a powerful valuation method used to estimate the value of an investment based on its expected future cash flows. It is widely used in finance for business valuation, investment decisions, and capital budgeting. This guide provides an in-depth explanation of the DCF method, its formula, and practical examples. What […]

The Future of CPA Firms: Private Equity, Technology, and Employee Wellness

CPA Firms have traditionally been the backbone of financial advice and compliance for businesses, but as the landscape evolves, they are faced with new challenges that require innovative solutions. In this blog post, we will explore how CPA firms can adapt to thrive in an ever-changing environment by leveraging private equity, embracing technology, and prioritizing […]

Balance Sheet: Explanation, Components, and Examples

The balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time. It is a crucial tool for investors, creditors, and analysts seeking to evaluate a company’s health and performance.

Accounts Payable: Definition, Process and Example

Accounts Payable (AP) operations play a crucial role in managing a company’s financial health. Handling the timely and accurate processing of vendor invoices, payments, and other financial obligations is essential for maintaining strong relationships with suppliers and ensuring smooth business operations. However, businesses often face the decision of whether to retain or outsource their AP […]

Modernizing the CPA Firm: An Employee-First Approach

In today’s rapidly changing economic landscape, the traditional CPA Firm model is being reevaluated. The demands of modern clients, coupled with the evolving expectations of employees, necessitate a shift towards a more contemporary, employee-centric structure. This overhaul not only aims to enhance productivity and client satisfaction but also focuses on improving the overall workplace environment […]

The Role of AI in Payroll: Trends to Watch in 2025

In the fast-paced world of business, efficiency is paramount. The integration of AI in payroll processes has revolutionized how organizations manage their employee compensation and benefits. With its ability to streamline operations, reduce errors, and offer valuable insights, AI in payroll emerges as a game-changer for businesses looking to enhance operational efficiency. Understanding the […]