6 Must-Know Blockchain Technology Concepts

Blockchain technology has the potential to improve basic trade finance services.

Blockchain is based on a decentralized, digitalized, and distributed ledger mechanism at its heart. This is more robust and secure by definition than the proprietary, centralized approaches now in use in the trade environment.

The distributed ledger, created by blockchain technology, is a viable, decentralized record of transactions that can replace a single master database. It retains an immutable record of all transactions, all the way back to the beginning. This is also known as provenance, and it is critical in trade finance since it allows financial institutions to analyze all transaction steps and reduce fraud risk.

The use of blockchain also provides a significantly more reliable method of creating and validating identification than current systems. The direct transfer of trade assets is substantially simplified by blockchain technology, which also boosts confidence in their provenance. This is accomplished by giving assets with unique, non-forgeable identities as well as a secure record of their ownership. As a result, further finance services based on the trading of real items are now possible.

1. The terms “blockchain” and “bitcoin” are not interchangeable.

Many individuals mistakenly believe that bitcoin and blockchain are the same things. Bitcoin’s underlying technology is called a blockchain. They have a lot in common, yet they aren’t the same.

Bitcoin, a sort of unregulated digital currency established by the pseudonymous Satoshi Nakamoto, was first released in 2008. Because there was no bank or government to supervise or police the transactions, blockchain was the ledger system utilized to securely record them, facilitating the adoption of this new currency. As a result, Bitcoin might be regarded the first application of blockchain technology. Because these two notions were developed at the same time, there is frequently confusion between them.

Bitcoin and blockchain transactions

Since its inception, blockchain technology has been expanded for use as a ledger solution in a variety of businesses involving assets other than money. These fields include healthcare, which includes patient data, trade finance, which includes who owns an invoice or purchase order, and insurance, which includes who owns a house or car.

Bitcoin is a cryptocurrency and the world’s first decentralized digital currency. It was created as an open-source solution that could be used without the need for a central repository or a single administrator. Bitcoin transactions are kept and transferred using a distributed ledger on a shared, open, and anonymous network. The underlying technology that keeps track of Bitcoin transactions is called the blockchain.

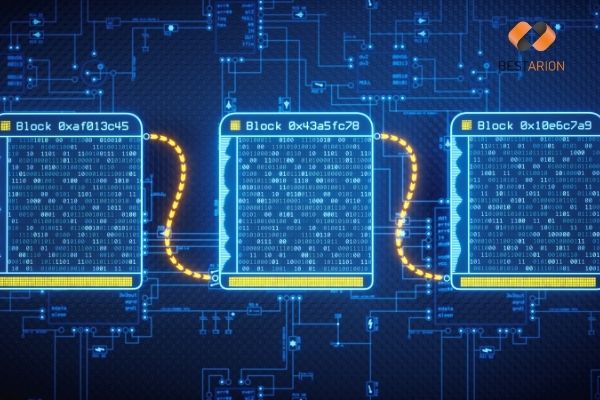

Blockchain technology, which is used for Bitcoin, enables the recording of transactions across a network of users on a distributed ledger. The open-source technique allows data from transactions to be stored in blocks. Each block contains a time-stamped record of the transactions, and each block is linked to the one before it, forming a chain. Without the capacity to edit or remove past transaction data from the distributed ledger, the information saved on the blockchain is totally transparent and permanent. This property and solution can be utilized to address a variety of inefficiencies in a variety of applications and industries.

While blockchain is a great choice for digital money, it can also be used to maintain a reliable audit trail of ownership for a wide variety of assets. These assets can be both intangible (trade finance assets, for example) and tangible (diamonds, for example). This results in a wide range of blockchain applications for many industries and institutions, like Marco Polo Network (previously known as TradeIX), which focuses on the trade finance business with dedicated blockchain solutions.

2. Data stored on the blockchain is open to the world.

This is just partially right. Some public blockchains are open to the world, while others are private and only accessible to certain people. The sort of blockchain required will be determined by the use case. Blockchains can be divided into three categories.

Blockchains that are open to the public

A user can become a member of the blockchain network on a public blockchain. This implies that after installing the necessary software on their device, individuals may store, send, and receive data. Because the blockchain is open to the entire globe, anyone can read and write the data contained in it.

The decentralization of a public blockchain is complete. All connected users share the same permissions to access and write data into the blockchain, and they must reach an agreement before any data is saved on the database.

Bitcoin is the most well-known example of a public blockchain. Users of digital currency can use a platform to conduct transactions directly between themselves.

Blockchains that are private

Permission to write, send, and receive data is controlled by a single organization in a private blockchain. Private blockchains are often utilized within a company, with only a few authorized users having access to it and transacting on it.

The controlling organization has the authority to change the rules of a private blockchain and to reject transactions based on their own set of rules and regulations.

A blockchain used by a corporation to interact with other divisions or a few permission individuals is an example of this.

Blockchains in collaboration

A consortium blockchain, also known as a permission blockchain, can be thought of as a cross between public blockchains’ low-trust model and private blockchains’ one highly-trusted entity model. Instead of allowing any user to participate in the transaction verification processor, on the other hand, enabling a single corporation to have complete control, a consortium blockchain allows only a few designated parties to participate. Only a small number of users are permitted to participate in the consensus process.

Consider a ten-bank consortium or network, each of which is connected to the blockchain network. In this case, we may suppose that seven out of ten banks must agree for a block to be valid.

Although this structure has some centralization, users can grant permissions to read and write to other users. As a result, consortium blockchains are designed to be partially decentralized. Consortia blockchains, like private blockchains, maintain data privacy while without aggregating authority within a single organization.

Marco Polo, for example, is a banking venture for trade finance that uses R3’s blockchain technology.

3. Everyone can see private information on the blockchain.

Because the distributed ledger is public, many people believe that all of their information and transaction data put on the blockchain are public. This is not the case.

Though visibility varies depending on the use case and technology used. To focus on this subject, all transactions between businesses are private and only visible to those with the right authorization. When a corporation uses blockchain to send data to its suppliers, it does not mean that its competitors can see who its suppliers are or what they’re buying. Suppliers are also unable to view the data of other suppliers. It’s all kept private and secure, and the providers only see the information that the buyer has given them permission to see.

While some transactional information can be made public, the value of the transaction and a hash are all that is saved on the distributed ledger. The hash is a code that is generated by using a cryptographic method to run the real transaction details. As a result, getting more information about the transaction is impossible.

4. A single blockchain exists.

The term blockchain is most commonly used to refer to a type of ledger technology rather than a specific product or service. A blockchain solution will have some type of consensus mechanism and will be distributed and underpinned by encryption.

However, there are public, permission, and private blockchains available. There are now hundreds of distinct protocols that are categorized as distributed ledger technologies and are referred to as Blockchains. Ethereum, R3’s Corda, IBM’s Fabric, and Ripple are just a few examples.

Some are very similar to one another, while others are very different. For the specific use, varied use cases, and applications, each blockchain system will have specific benefits and drawbacks.

5. Smart Contracts are legally binding contracts.

The term “smart contract” is ambiguous. They are neither “smart” nor a “contract” in the traditional sense of the term. Smart Contracts, coined in 1994 by cryptography expert Nick Szabo, are essentially scripts or software programs developed by developers and placed onto a blockchain. They’re frequently triggered by events and written us transaction instructions. Release the payment to the supplier if products arrive at this customer’s warehouse by this date, for example. Smart Contracts can complete operations automatically as a result of companies updating shipments and receipts. This reduces the need for time-consuming and expensive manual business procedures to be managed.

A smart contract is computer software that automates the implementation of business logic, agreements, and obligations.

An electronic warehouse receipt, a bond, an invoice, a unit of power, a unit of currency, a futures contract, a share of risk, and much more can all be represented by a smart contract. Users on the network can produce, trade, and settle these cryptographically unique assets in real-time. Almost any form of business logic can be included in a smart contract. This business logic can be implemented automatically in accordance with the agreement’s terms and conditions.

As inputs are received, the contract responds by carrying out any responsibilities or conditions dictated by the contract’s logic.

- A GPS point showing a ship’s arrival at the correct port might instantly trigger payment to the ship’s cargo vendor.

- The smart contract could be triggered to sell an option on a commodity-based on the current price of that commodity.

- If and when other requirements are met, a buyer’s signature on an invoice can create a payment obligation that is immediately executed on the designated date.

- A vending machine can compensate the drone that restocks it when the restocking is completed and based on the inventory it has been stocked with.

- Collateral is transferred to the creditor following default event as received in the court filing system.

6. Blockchain is merely a marketing term.

First and foremost, blockchain is a genuine technology that exists today. Blockchain is currently being tested using proofs-of-concept (POCs) in a variety of businesses and places all over the world. Also, keep in mind that this technology is still in its infancy. In 2017, a number of blockchain vendors, including IBM and R3, introduced version 1 of their technologies. So, everything is brand fresh and developing right in front of our eyes.

Indeed, blockchain has become an overused phrase, with many media and press outlets covering it on a regular basis. This does not imply that it is merely a marketing gimmick, as the investment figures speak for themselves.

Capital markets businesses spent over $280 million on blockchain technology in 2016, with 90% of North American and European banks studying blockchain solutions. 2 Over $1.4 billion was invested in blockchain start-up companies globally in the same year. 3 Approximately half of the world’s largest banks are already collaborating with a technology firm to improve their blockchain capabilities. 4

The potential efficiency gains for financial institutions are aligned with investments in technology and new companies. The largest eight banks are expected to save more than $8 billion each year, according to Accenture. There is a potential for 70 percent cost reductions in corporate operations and 30-50 percent cost savings in compliance by utilizing blockchain technology.

Related Article:

https://www.marcopolonetwork.com/resources/essential-blockchain-technology-concepts/