10 Must-Know Finance and Accounting Trends in 2024

In the dynamic landscape of finance and accounting, staying ahead of emerging trends is pivotal for businesses and professionals aiming for sustained success. As 2024 unfolds, the industry continues to undergo rapid transformations, driven by technological advancements, evolving regulations, and shifting market dynamics. Adapting to these changes is crucial for organizations seeking to optimize operations, enhance decision-making, and navigate an increasingly complex financial landscape.

Let’s explore the ten finance and accounting trends that demand attention and adaptation in 2024:

Exploring 10 Game-Changing Finance and Accounting Trends in 2024

1. Automation and AI Integration

Automation and AI Integration are dramatically reshaping the finance and accounting industry. Artificial Intelligence (AI) and Machine Learning (ML) are not just buzzwords but have become integral tools in automating routine and complex tasks. The adoption of these technologies is enhancing efficiency, reducing human error, and allowing professionals to focus on more strategic aspects of their roles.

One significant area of impact is financial reporting. AI algorithms can analyze vast amounts of data quickly, providing insights and forecasts with a high degree of accuracy. This capability is invaluable in budgeting, forecasting, and risk management. Furthermore, machine learning models can continuously learn and adapt, improving their performance over time.

Another aspect of automation is in transaction processing. AI can streamline processes such as invoice processing, payroll, and reconciliations, often with greater accuracy and lower costs than traditional methods. This shift is not just about replacing manual labor but also about enhancing decision-making and strategic planning.

The integration of AI in finance also raises questions about job displacement. However, rather than eliminating jobs, AI is more likely to transform them. Professionals will need to adapt, gaining skills in managing and interpreting AI outputs. The role of the accountant or financial professional is thus evolving, with a greater focus on analysis, interpretation, and strategic advice.

Embracing AI and automation is no longer optional but a necessity for staying competitive and efficient in the rapidly changing financial landscape. Organizations and professionals must invest in these technologies and the required skills to harness their full potential.

2. Blockchain Technology

Blockchain technology has emerged as a game-changer, offering unparalleled transparency and security in financial transactions. Unlike traditional centralized systems, blockchain operates on a decentralized ledger, where transactions are recorded across multiple nodes, making alteration virtually impossible. This inherent immutability makes blockchain an ideal solution for enhancing transparency in financial dealings.

In the realm of auditing and compliance, blockchain holds immense promise. Auditing, traditionally a time-consuming process, can be revolutionized through blockchain’s immutable and transparent nature. Every transaction recorded on a blockchain is time-stamped and traceable, enabling auditors to verify data efficiently. This capability significantly reduces the time and resources required for audits while enhancing accuracy.

Moreover, compliance procedures can be streamlined using blockchain technology. Smart contracts, self-executing contracts with predefined conditions stored on a blockchain, can automate compliance activities. These contracts ensure that all involved parties adhere to predetermined rules and regulations, reducing the risk of errors or fraud.

Financial institutions are exploring blockchain for regulatory compliance, ensuring that transactions meet the required standards. The technology’s tamper-proof nature instills trust and credibility in the financial system, paving the way for a more secure and transparent future in finance. As blockchain continues to mature, its applications in auditing and compliance are poised to reshape the financial industry’s landscape.

3. Cloud-Based Solutions

The growth of cloud-based solutions has been transformative, particularly in the realm of accounting and finance. Cloud accounting software has revolutionized the way businesses manage their financial data by offering real-time access and insights into their financial health.

One of the primary advantages of cloud accounting software is its ability to provide real-time financial data access. Gone are the days of relying on static, periodically updated spreadsheets. Now, businesses can access their financial information instantly from anywhere with an internet connection. This accessibility allows for better decision-making based on up-to-date information and facilitates collaboration among teams, regardless of geographical barriers.

Scalability is another key benefit offered by cloud-based solutions. As businesses expand or experience fluctuations in their operations, cloud accounting software can easily scale up or down to accommodate changing needs. Companies no longer need to invest in additional hardware or worry about storage constraints. Cloud-based systems offer flexibility, allowing businesses to adapt their accounting infrastructure to match their growth trajectory seamlessly.

Furthermore, remote access capabilities inherent in cloud solutions enable teams to work collaboratively from diverse locations. This capability has become increasingly essential in today’s remote work environment, ensuring continuity in financial operations without being tethered to a specific physical location.

The shift towards cloud-based accounting solutions marks a significant paradigm shift, offering enhanced accessibility, flexibility, and scalability that traditional on-premises systems struggle to match. As technology continues to evolve, the adoption of cloud-based accounting software is expected to become even more widespread, fundamentally changing how businesses manage their financial data.

4. Cybersecurity Enhancements

In the contemporary digital landscape, the necessity for robust cybersecurity measures to safeguard financial data has never been more critical. The financial sector, handling vast volumes of sensitive information, faces persistent threats from cybercriminals seeking unauthorized access, data breaches, or ransomware attacks. Thus, advanced cybersecurity measures have become imperative to ensure the integrity, confidentiality, and availability of financial data.

To counter these threats, emerging technologies are continuously being developed and implemented in the realm of data protection. Encryption, for instance, remains a fundamental tool in securing financial information by encoding data, rendering it unreadable without the corresponding decryption key. Advanced encryption protocols are continually evolving to keep pace with sophisticated hacking techniques, ensuring stronger protection for sensitive financial data.

Moreover, technologies like artificial intelligence (AI) and machine learning are increasingly employed in cybersecurity. These technologies empower systems to detect anomalies and identify potential threats by analyzing vast amounts of data, thereby enhancing the ability to predict and prevent cyberattacks before they cause significant damage.

Additionally, biometrics, such as fingerprint or facial recognition, are gaining traction as highly secure authentication methods in financial institutions. Biometric data, being unique to each individual, provides an additional layer of security in access control, reducing the risk of unauthorized access to sensitive financial systems or data.

As cyber threats continue to evolve, so too must the technologies employed to combat them. By staying at the forefront of innovative cybersecurity measures, financial entities can mitigate risks and fortify their defenses against constantly evolving cyber threats, ensuring the safety and security of financial data.

5. Regulatory Technology (RegTech)

Regulatory Technology, or RegTech, represents the innovative use of technology to address the intricate landscape of regulatory challenges within the finance and accounting sectors. With a multitude of regulations and compliance requirements, financial institutions face a considerable burden in ensuring adherence while also managing operational efficiency.

The integration of technology in RegTech solutions offers automation capabilities that streamline compliance and reporting processes. By leveraging automation tools, firms can efficiently navigate through complex regulatory frameworks. These tools enable the automation of repetitive tasks, such as data collection, analysis, and reporting, minimizing human errors and ensuring accuracy and consistency in compliance efforts.

Moreover, RegTech solutions utilize machine learning algorithms and AI-driven analytics to interpret vast amounts of data, enabling financial institutions to identify potential compliance risks proactively. This proactive approach aids in mitigating risks before they escalate, ensuring adherence to regulations and avoiding penalties or reputational damage.

The deployment of RegTech solutions not only enhances the efficiency of compliance processes but also reduces operational costs by optimizing resource allocation. These technologies facilitate the creation of a more robust compliance infrastructure, allowing organizations to adapt swiftly to regulatory changes while maintaining compliance standards effectively.

Overall, the adoption of RegTech solutions represents a significant step forward in managing regulatory challenges. Through the automation of compliance and reporting functions, financial institutions can navigate the complex regulatory landscape more efficiently and effectively, ensuring both regulatory compliance and operational excellence.

6. Advanced Data Analytics

Big data analytics has emerged as a powerful tool transforming the landscape of financial decision-making. The sheer volume and variety of data generated within the financial sector have opened doors to extracting valuable insights that were previously inaccessible.

Big data analytics enables financial institutions to process and analyze massive datasets at an unprecedented scale and speed. By leveraging this wealth of information, businesses can derive actionable insights, identify patterns, and make informed decisions. For instance, banks can analyze customer spending patterns to tailor personalized financial products, while investment firms can use market trend analysis to optimize their portfolios.

One of the most impactful facets of big data analytics in finance is predictive analytics. By employing sophisticated algorithms and machine learning techniques, financial entities can forecast future market trends, customer behavior, and potential risks. Predictive analytics empowers organizations to anticipate market shifts, identify potential opportunities, and mitigate risks in advance, thus enhancing the effectiveness of financial strategies.

Moreover, these predictive models enable more accurate risk assessment, allowing institutions to make data-driven decisions that align with their risk tolerance and financial objectives. From credit risk assessment to fraud detection and portfolio optimization, predictive analytics significantly influences and refines financial strategies, leading to better outcomes and improved performance in a highly competitive financial landscape.

7. Personalized Financial Services

The advent of technology has revolutionized how financial services are delivered, shifting the focus toward personalized experiences that cater to individual customer needs. Through advanced analytics, artificial intelligence (AI), and machine learning, financial institutions can now offer tailor-made services that resonate with each customer’s unique preferences and requirements.

Technology allows for a deep understanding of customer behavior, financial habits, and preferences through data analysis. This knowledge empowers financial institutions to create personalized financial solutions that precisely match individual customer needs. For instance, banks can recommend personalized investment portfolios based on risk tolerance, income levels, and financial goals, while insurance companies can offer customized policies aligning with specific coverage needs.

The impact of personalized financial services extends to customer service, significantly enhancing satisfaction and loyalty. By offering bespoke solutions and experiences, financial institutions can strengthen their relationships with customers, leading to higher engagement and retention rates. Moreover, personalized services contribute to a more seamless and efficient customer journey, fostering trust and loyalty.

Furthermore, this personalized approach drives innovation in product offerings. Financial institutions continually refine and develop new products and services tailored to address specific customer pain points or emerging trends. This innovation not only meets customer expectations but also creates competitive advantages in the market by offering unique and valuable solutions.

In conclusion, the integration of technology in offering personalized financial services elevates customer experiences, augments customer service standards, and drives innovation in product offerings. By leveraging data-driven insights, financial institutions can establish stronger connections with their customers, thereby fostering long-term relationships and enhancing overall satisfaction.

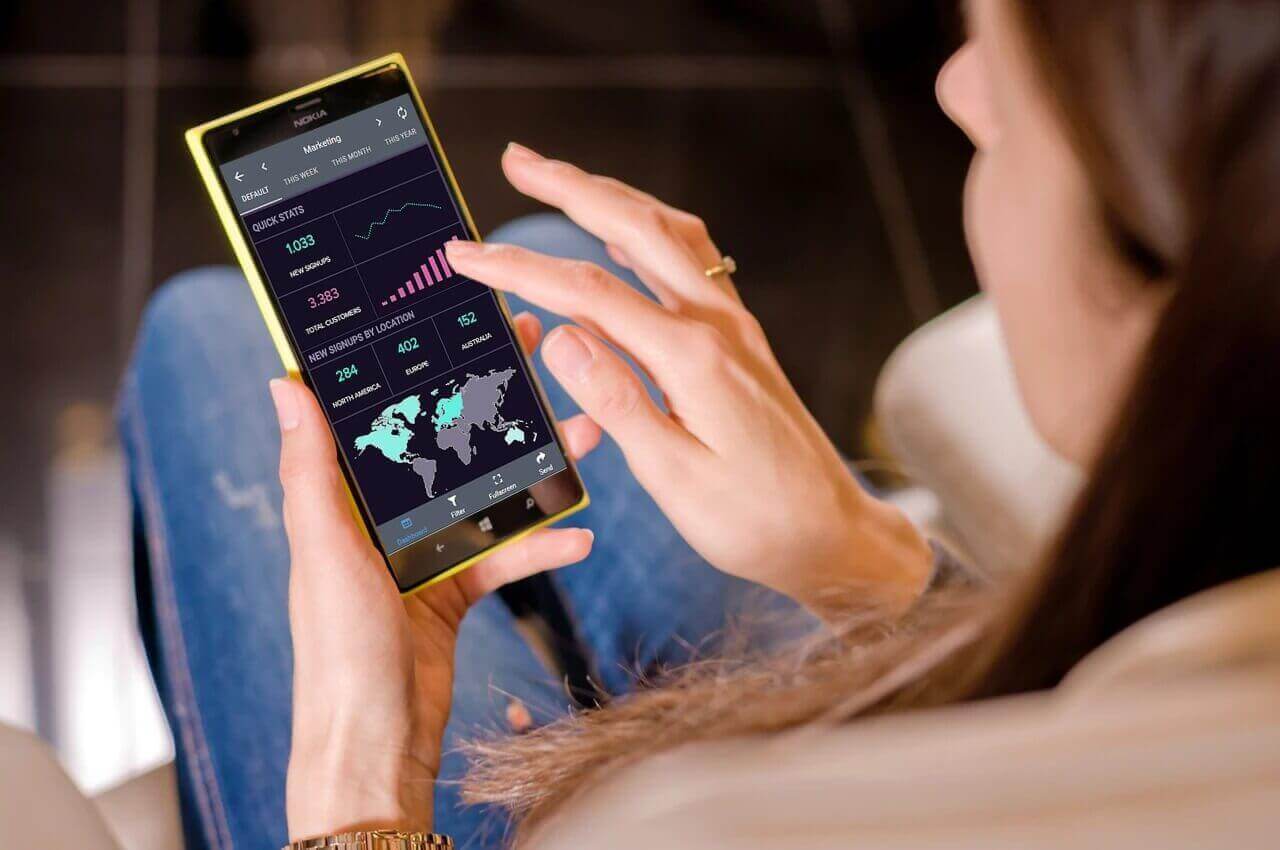

8. Mobile Finance Management

The surge in mobile applications dedicated to financial management and transactions marks a significant shift towards a mobile-first approach in the realm of financial services. The ubiquity of smartphones and the convenience they offer have transformed the way individuals manage their finances.

Mobile finance management apps have become indispensable tools for users to track expenses, create budgets, and monitor investments on the go. These applications offer real-time access to financial information, allowing users to check account balances, transfer funds, pay bills, and even receive investment updates—all from the palm of their hand.

Moreover, the shift towards a mobile-first approach in financial services reflects the changing preferences of consumers, who increasingly prioritize convenience and accessibility. Financial institutions are responding to this shift by investing in user-friendly mobile interfaces, ensuring seamless and secure experiences for customers across various financial activities.

The convenience of mobile finance management apps has not only empowered users but has also catalyzed financial inclusion by providing access to financial services for individuals who were previously underserved or unbanked. This accessibility fosters greater financial literacy and empowers users to take control of their financial well-being.

As the mobile finance landscape continues to evolve, the integration of innovative features, such as biometric authentication and AI-driven financial advice, is further enhancing the user experience. The trend towards mobile finance management is poised to persist and expand, redefining how individuals engage with financial services in a digitally-driven world.

9. Rise of Fintech and Digital Currencies

The rise of Fintech startups has profoundly influenced traditional financial services, introducing innovative technologies and disrupting traditional business models. These startups leverage technology to offer streamlined and user-centric financial solutions, challenging the dominance of established financial institutions.

Fintech companies have introduced various innovations such as peer-to-peer lending, robo-advisors, mobile payment solutions, and blockchain-based services. These innovations have democratized access to financial services, offering faster, more accessible, and cost-effective alternatives to traditional banking systems. Moreover, they have compelled traditional financial institutions to adapt, innovate, and enhance their services to stay competitive in the evolving landscape.

Simultaneously, the growing acceptance and regulation of digital currencies, notably cryptocurrencies like Bitcoin and Ethereum, have garnered significant attention. Initially met with skepticism, these digital currencies have gained traction as legitimate financial assets. Regulatory bodies have increasingly acknowledged the significance of digital currencies, devising frameworks to regulate and integrate them into the mainstream financial system.

The integration of digital currencies into the financial ecosystem has implications beyond just investment opportunities. The underlying blockchain technology has potential applications in various industries, from revolutionizing supply chain management to enhancing transparency in record-keeping.

As fintech innovations and digital currencies continue to reshape the financial landscape, collaboration between traditional financial institutions and fintech startups is increasingly common. This collaboration aims to harness the strengths of both sectors, fostering innovation, and providing customers with a broader array of accessible and technologically advanced financial services.

10. Sustainability Reporting

The surge in demand for Environmental, Social, and Governance (ESG) reporting signifies a pivotal shift in corporate priorities, emphasizing the integration of sustainability considerations into business strategies. This movement reflects a growing awareness among stakeholders, including investors, customers, and regulators, regarding the impact of businesses on the environment, society, and governance practices.

Companies are increasingly recognizing the importance of sustainability metrics and are integrating them into their financial reports. This integration allows stakeholders to gain comprehensive insights into a company’s performance, not just in terms of financial gains but also its impact on environmental and social aspects. Sustainability reporting includes metrics related to carbon emissions, diversity and inclusion practices, community engagement, ethical governance, and more.

Investors are showing a heightened interest in companies that exhibit strong ESG practices, considering these factors as indicators of long-term viability and risk management. Incorporating sustainability metrics into financial reports enables investors to evaluate a company’s commitment to sustainable practices and assess its resilience in navigating global challenges, thereby influencing investment decisions.

Moreover, businesses are leveraging sustainability reporting as a means to foster transparency and accountability, enhancing their reputation and trust among stakeholders. As the demand for ethical and sustainable practices continues to grow, integrating sustainability metrics into financial reports has become a crucial aspect of demonstrating a company’s commitment to responsible business practices and long-term value creation.

Conclusion

In retrospect, the landscape of finance and accounting in 2024 is undergoing a significant transformation fueled by technological advancements, evolving consumer expectations, and a heightened focus on sustainability and compliance. The key trends highlighted throughout this discourse collectively paint a picture of the future direction and potential impact on these industries.

From automation and AI integration to the rise of Fintech and digital currencies, each trend signifies a paradigm shift in how financial operations are conducted, data is managed, and services are delivered. Blockchain’s influence on transparency, the surge in personalized financial services, and the growing emphasis on sustainability reporting underscore a fundamental change in how businesses operate and interact with their stakeholders.

The integration of advanced data analytics and the widespread adoption of cloud-based solutions further solidify the need for a forward-thinking approach to managing financial data and making informed decisions. Moreover, the growing acceptance and regulation of digital currencies exemplify the changing perceptions and expanding possibilities within the financial ecosystem.

In conclusion, the ever-evolving nature of finance and accounting demands adaptability and a commitment to continuous learning. Professionals and businesses alike must embrace these trends, leveraging them as opportunities to innovate, optimize operations, and deliver enhanced services. Success in this dynamic field hinges on the ability to not just keep pace with change but to proactively anticipate and leverage these trends to drive growth, ensure compliance, and meet evolving consumer needs. Emphasizing adaptability and a thirst for ongoing learning will be the cornerstone for thriving in the dynamic landscape of finance and accounting in the years ahead.