In today’s complex financial landscape, the role of certified public accountants (CPAs) and their auditing support for CPAs has evolved significantly. One of the most crucial aspects of their responsibilities is providing effective auditing support for CPAs. This involves not just understanding the regulations and standards but also utilizing advanced tools and techniques to streamline […]

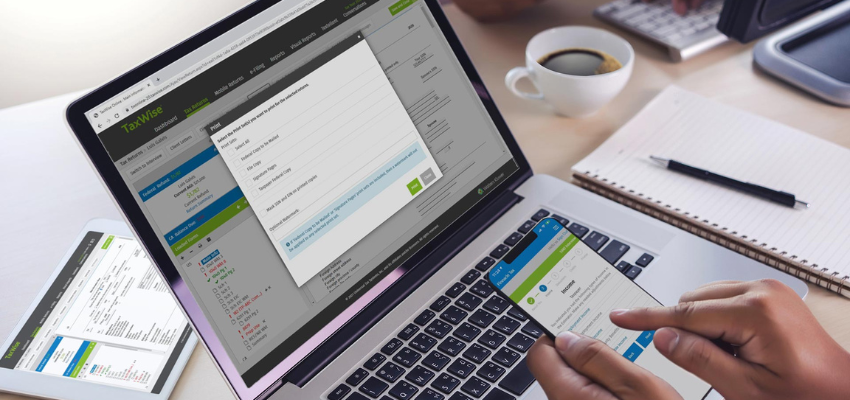

Unlock Convenience with Online Tax Services

In today’s fast-paced world, online tax services have emerged as a game-changer for individuals and businesses alike. Navigating the complex landscape of tax codes, deductions, and filings can be daunting, but these digital platforms streamline the process. By harnessing technology, taxpayers can ensure they meet their obligations without sacrificing time or sanity. This evolution reflects […]

Understand Different Types of Business Tax Preparation Services

In the intricate world of finance, business tax preparation services serve as a crucial pillar for business owners. Proper handling of taxes can mean the difference between profit and loss, compliance or fines, and growth or stagnation. This article aims to delve into the various types of business tax preparation services available in the market […]

Revamp Your Strategy to Simplify Tax Season

Tax season can often feel like a dreaded time of year, filled with stress and confusion. However, with the right strategies in place, it is possible to simplify tax season and alleviate some of that pressure. This article will delve into effective methods for streamlining your tax preparation process, ensuring you’re not only compliant but […]

Transforming Tax Season Efficiency with AI and Automation

Tax season is often considered a daunting period for individuals and businesses alike, filled with the stress of paperwork, deadlines, and complicated calculations. However, the advent of artificial intelligence (AI) and automation is revolutionizing tax season efficiency, making it easier than ever to navigate this annual process. By streamlining tasks, enhancing accuracy, and providing insightful […]

Maximize Your Returns This Tax Season 2025

As we approach the tax season 2025, many individuals and businesses begin to contemplate their financial standing and how best to manage their tax obligations. Understanding the intricacies of tax regulations, credits, deductions, and strategies can significantly impact your returns. By taking proactive steps now, you can maximize your savings and make informed decisions that […]

Optimizing Your Tax Planning Strategy for Business Growth

In the world of business, having an effective tax planning strategy is crucial for sustainable growth and profitability. Implementing a well-thought-out tax approach can not only help minimize tax liabilities but also enhance cash flow, allowing entrepreneurs to reinvest in their businesses. This article aims to delve deep into various aspects that contribute to optimizing […]

Best tax preparation software for small businesses

Tax preparation software is a critical resource that can aid in streamlining processes, ensuring compliance, and maximizing deductions. Choosing the best one tailored to your specific needs can provide substantial returns on investment, both in terms of time saved and money saved. In this comprehensive article, we will explore various facets of tax preparation software […]

Essential Tax Planning Strategies Every CPA Firm Should Know

Tax planning strategies are vital for both individuals and businesses as they navigate the often-complex world of taxes. For CPA firms, understanding and implementing effective tax planning strategies not only enhances their service offerings but also empowers clients to optimize their tax positions. This article delves into essential tax planning strategies that every CPA firm […]

The Complete Guide to Outsourced Tax Preparation Services for Businesses

In today’s fast-paced world, managing financial responsibilities can often feel overwhelming. This is where an outsourced tax preparation service comes into play, offering individuals and businesses a valuable solution for their tax-related needs. By delegating tax preparation tasks to professionals, you not only save time and energy but also ensure accuracy and compliance with the […]