Becoming a tax preparer is an exciting journey that can lead to a fulfilling career in the financial sector. As individuals and businesses grapple with ever-evolving tax laws, the demand for skilled tax preparers continues to grow. With the right knowledge, skills, and dedication, anyone can embark on this path and contribute significantly to helping others navigate […]

Efficient CPA Tax Preparation Strategies for Small Businesses

CPA tax preparation is an essential part of ensuring that small businesses remain compliant with tax regulations while maximizing their financial efficiency. Many entrepreneurs and small business owners often find themselves overwhelmed with the complexities of tax laws, which can lead to costly mistakes or missed opportunities for savings. By implementing effective strategies for CPA […]

Navigating Your US Tax Return – Essential Tips and Insights

Understanding how to effectively manage your US tax return can be a daunting task, especially for those who are new to it or have complicated financial situations. The IRS regulations and requirements may seem overwhelming, but fear not! This article will provide you with detailed insights into using your US tax return, including examples, comparisons, […]

Transform Your Tax Filing with Virtual Tax Preparation Services

In today’s fast-paced digital, many individuals and businesses are turning to a virtual tax preparation service for their tax filing needs. This modern approach not only simplifies the process but also makes it more efficient, allowing taxpayers to focus on what truly matters. With technology enabling us to connect remotely, virtual tax reparations has become […]

Navigating the End of Tax Season: Essential Tips for a Stress-Free Transition

As we approach the end of tax season, it’s essential to understand what this time means for individuals and businesses alike. The conclusion of this period can bring relief, confusion, or even panic depending on one’s preparation levels. Whether you are filing your taxes yourself or working with a professional, the end of tax season […]

Unlocking the Secrets of CE for Tax Preparer

In the ever-changing landscape of the tax preparation industry, CE for tax preparers has become an essential component for professionals seeking to enhance their knowledge and maintain compliance. Continuing education (CE) not only helps tax preparers fulfill regulatory requirements but also equips them with vital skills and insights necessary for navigating complex tax laws and […]

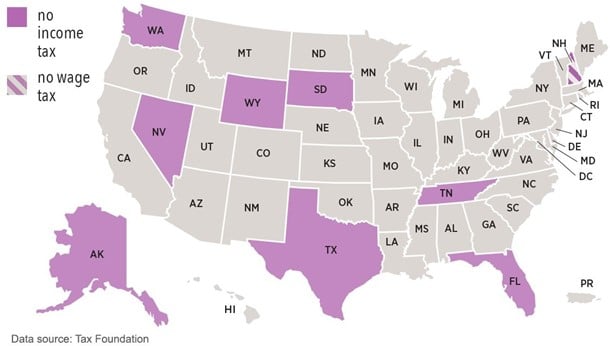

States With No Income Tax: The Best Places to Keep More of Your Money

One of the biggest financial concerns for Americans is how much of their income goes to taxes. While federal income tax is unavoidable, state income tax varies significantly across the U.S. In fact, some states have no income tax at all, making them attractive destinations for workers, retirees, and business owners looking to maximize their […]

Payroll Tax: Everything Employers and Employees Need to Know

Payroll tax is a fundamental aspect of employment that affects both employers and employees. Understanding payroll tax is crucial for compliance, accurate financial reporting, and effective business operations. In this guide, we’ll explore payroll tax essentials, including types, calculations, compliance requirements, and best practices for businesses. What is a Payroll Tax? A payroll tax is […]

Explore the Steps to Becoming a Tax Accountant by 2025

Embarking on a journey to become a tax accountant is both a fulfilling and challenging endeavor. With the ever-evolving landscape of tax laws and regulations, this profession requires not only a deep understanding of financial principles but also an ability to navigate complex legal frameworks. The role of a tax accountant is vital for individuals […]

Maximize Savings through Expert Tax Planning Services

Tax planning services are essential for individuals and businesses looking to navigate the complex landscape of tax regulations while maximizing savings. These services go beyond simple tax preparation; they involve strategic analysis and guidance that can significantly reduce tax liabilities, enhance financial returns, and ultimately lead to better economic outcomes. The importance of effective tax […]