States With No Income Tax: The Best Places to Keep More of Your Money

One of the biggest financial concerns for Americans is how much of their income goes to taxes. While federal income tax is unavoidable, state income tax varies significantly across the U.S. In fact, some states have no income tax at all, making them attractive destinations for workers, retirees, and business owners looking to maximize their earnings.

In this article, we’ll explore the nine states with no income tax, analyzing their economic benefits, cost of living, and other tax structures that help them remain financially sustainable. If you’re considering relocating to a tax-friendly state, this guide will help you understand the key factors to weigh before making a move.

Key Takeaways:

- Nine U.S. states, including Texas, Florida, and Washington, impose no personal income tax, offering residents higher take-home pay but often offsetting the loss through higher sales or property taxes.

- State income tax systems vary, with some using progressive rates, others flat rates, and a few imposing no tax at all – impacting overall cost of living and tax burdens.

- Tax-friendly states can be especially appealing to retirees, particularly those that don’t tax Social Security or retirement account distributions.

- Living in a state with no income tax isn’t always cheaper, as reduced tax revenue can lead to higher costs in other areas or reduced public services.

What is a State Income Tax?

A state income tax is a tax imposed by a state government on the income earned by its residents, as well as on nonresidents who earn income sourced from that state. It is similar to the federal income tax but is collected by individual states to fund state-level services and programs.

Not all states impose this tax – it’s called states with no state tax. For example, Florida, Texas, and Nevada do not collect state income tax. However, most other states do. Tax rates and how they are calculated vary from state to state.

Types of State Income Tax

There are three main types of state income tax systems in the U.S., and each state chooses the approach that fits its goals and values. Here’s a simple breakdown:

Progressive State Income Tax

A progressive state income tax is a system where the tax rate increases as a person’s income rises. This means people who earn more money pay a higher percentage of their income in taxes compared to those who earn less. It’s designed to be fairer by asking higher earners to contribute more.

Most U.S. states use this system, including California and New York, to help fund public services like education, healthcare, and transportation through a more balanced tax structure.

Flat State Income Tax

A flat state income tax is a system where everyone pays the same tax rate, no matter how much money they earn. Whether you make $25,000 or $250,000, the percentage of income taxed is exactly the same. This approach is simpler and easier to manage, which is why some states like Colorado and Illinois use it.

However, critics argue it can be unfair to lower-income individuals, as it takes a larger share of their limited earnings compared to wealthier taxpayers.

States with progressive tax structures

No state income tax means that a state does not collect any tax on personal income. Residents in these states – like Texas, Florida, and Washington – only pay federal income taxes, which can help them keep more of their earnings.

However, to make up for the lost revenue, these states often rely more heavily on other taxes, such as sales or property taxes. While appealing to many, this system can lead to higher costs in other areas to support public services.

State Tax Rates in 2025

State income tax rates vary widely across the U.S., from 0% in states like Texas and Florida to over 13% in California. In 2025, some states have adopted flat tax systems, while others use progressive brackets to tax higher incomes more heavily. Understanding these differences is essential for individuals planning a move, tax strategy, or business expansion.

This overview breaks down which states have no income tax, the highest and lowest rates, and the key trends for the year ahead.

Income tax rates by state (2025)

| Type | State | Tax Rate (2025) |

| No Income Tax | Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming | 0% |

| Flax Tax | 0% on wages, but taxes dividends/interest | |

| Flat Tax | Arizona | 2.5% |

| Colorado | 4.4% | |

| Georgia | 5.39% | |

| Idaho | 5.695% | |

| Illinois | 4.95% | |

| lndiana | 3% | |

| lowa | 3.8% (new in 2025) |

| Kentucky | 4% | |

| Louisiana | 3% | |

| Michigan | 4.25% | |

| Mississippi | 4.4% | |

| North Carolina | 4.25% | |

| Pennsylvania | 3.07% | |

| Utah | 4.55% | |

| Progressive Tax | California | 1% – 13.3% |

| Hawaiii | 1.4% – 11% | |

| New York | 4% – 10.9% |

| New Jersy | 1.4% – 10.75% | |

| Oregon | 4.75% – 9.9% | |

| Minnesota | 5.35% – 9.85% | |

| Vermont | 3.35% – 8.75% | |

| Connecticut | 3% – 6.99% | |

| Wisconsin | 35% – 7.65% | |

| Montana | 6.75% – 7% | |

| Others (varies) | Usually range from 2% to 7% based on income |

States with highest tax rates in 2025

In 2025, California holds the highest state income tax rate at 13.3%, with an additional 1.1% surcharge for incomes over $1 million. Hawaii follows with a top rate of 11%, and New York comes next at 10.9%.

Other high-tax states include New Jersey (10.75%), Oregon (9.9%), Minnesota (9.85%), Massachusetts (9%), and Vermont (8.75%). These progressive tax systems primarily target high earners to help fund state programs and public services.

States with lowest tax rates in 2025

Here are the states with the lowest top marginal income tax rates in 2025, focusing on those that still levy a personal income tax:

- Arizona and North Dakota: both at 2.5%

- Indiana and Louisiana: 3.0% flat rate

- Iowa: newly set flat rate at 3.8% in 2025

Additionally, Pennsylvania (3.07%) and Kentucky (4%) are among the lower flat-rate states . Apple-to-apple, Arizona and North Dakota offer the lowest personal income tax burden in 2025. While nine states (including Texas, Florida, and Alaska) impose no state income tax at all, Arizona and North Dakota lead among those who do.

States With No Income Tax: A Closer Look

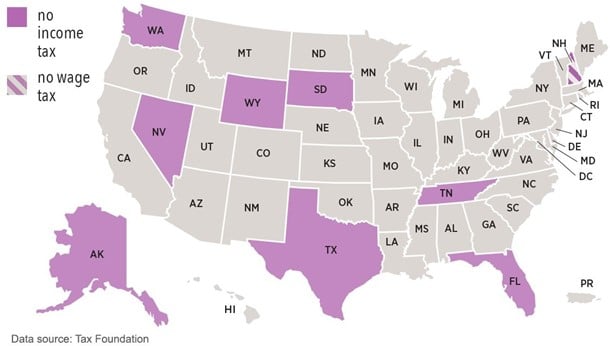

List of states with no income tax (2025)

Currently, nine U.S. states impose no personal income tax:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

- New Hampshire (No tax on wages but taxes investment income)

Each of these states has its own way of compensating for the loss of income tax revenue, whether through sales tax, property tax, or other levies. Let’s dive into each state’s tax structure, economy, and livability.

Comparison of states with no income tax (2025)

Before making the move to a no-income-tax state, it’s essential to evaluate other financial and lifestyle factors, including:

- Sales, excise, and property taxes – Some states offset the lack of income tax with higher taxes in these areas.

- Overall affordability – Consider the cost of housing and living expenses.

- Impact on public services – Lower tax revenue may affect infrastructure, education, and healthcare quality.

Tax laws are also subject to change. For instance, Tennessee previously taxed investment and interest income, but the Hall Income Tax was fully repealed on January 1, 2021.

The table below compares states with no income tax, highlighting:

- Total tax burden (income, sales, excise, and property taxes) as a percentage of personal income.

- State’s tax burden ranking (best to worst among all 50 states).

- Affordability ranking, factoring in housing costs and cost of living.

- Overall ranking on the U.S. News & World Report’s “Best States” list.

This comparison helps determine whether a state’s tax-friendly policies truly align with your financial goals.

| Comparison of States with No Income Tax | ||||

|---|---|---|---|---|

| No-Tax State | Total Tax Burden (% of Income) | Total Tax Burden Rank (1=lowest) | Affordability (1=best) | Best States Rank (1=best) |

| Alaska | 4.93% | 1 | 35 | 45 |

| New Hampshire | 5.63% | 2 | 44 | 2 |

| Wyoming | 5.70% | 3 | 19 | 12 |

| Florida | 6.05% | 4 | 39 | 9 |

| Tennessee | 6.07% | 5 | 18 | 27 |

| South Dakota | 6.44% | 7 | 5 | 11 |

| Nevada | 7.37% | 10 | 33 | 33 |

| Texas | 7.56% | 14 | 28 | 29 |

| Washington | 8.04% | 22 | 47 | 8 |

Sources: U.S. News & World Report, WalletHub

States With No Income Tax: A Closer Look

1. Alaska

Total Tax Burden: 4.93% (Lowest in the U.S.)

Key Benefits: No state sales tax, high oil revenue payouts

Downsides: Harsh winters, high cost of living

Alaska is one of the most tax-friendly states, with no state income or sales tax. Residents enjoy the lowest overall state and local tax burden at just 4.93% of personal income.

A unique benefit of living in Alaska is the Alaska Permanent Fund Dividend (PFD), which distributes annual payments to residents from state revenue and investment earnings on mineral lease rentals and royalties. In 2023, the PFD payment was $1,312 per resident.

However, Alaska has one of the highest healthcare costs in the U.S., with spending reaching $13,642 per capita in 2020—the highest among states, excluding Washington, D.C. Similarly, education spending is high, with $20,191 per student in 2022, placing it in the top quartile for education investment.

Tax Structure in Alaska

- Income tax: None

- Sales tax: None (some local jurisdictions impose sales tax)

- Property tax: Moderate to high, depending on the area

2. Florida

Total Tax Burden: 6.05% (4th Lowest in the U.S.)

Key Benefits: No state income tax, warm climate, retirement-friendly

Downsides: High tourism-driven economy, rising home insurance costs

Florida’s lack of a state income tax makes it a popular destination for retirees and high-income earners. However, sales and excise taxes exceed the national average, contributing to an overall tax burden of 6.05%.

While Florida is ranked ninth on U.S. News & World Report’s “Best States” list, its affordability has declined in recent years. In 2024, Florida ranked 39th in affordability, largely due to rising housing costs—down from 31st in 2020.

- Education spending: Florida ranks among the lowest in the nation, with $11,076 per student in 2022.

- Infrastructure: In 2021, the American Society of Civil Engineers (ASCE) gave Florida a “C” grade for its infrastructure.

- Healthcare: Spending increased from $8,076 per capita in 2014 to $9,865 per capita in 2020.

Although Florida does not tax individual income, businesses face a 5.5% corporate income tax. However, LLCs, sole proprietorships, and S corporations are either partially or fully exempt from this tax.

Tax Structure in Florida

- Income tax: None

- Sales tax: 6% (varies by county)

- Property tax: Relatively moderate

3. Nevada

Total Tax Burden: 7.37% (10th Lowest in the U.S.)

Key Benefits: Business-friendly environment, no state income tax

Downsides: High sales tax, expensive housing in Las Vegas

Nevada does not impose a state income tax but compensates with high sales taxes on goods, sin taxes on alcohol and gambling, and levies on casinos and hotels. As a result, Nevadans face a total tax burden of 7.37% of personal income, ranking 10th lowest nationwide.

However, the high cost of living and housing makes Nevada less affordable, placing it 33rd in affordability. The state also holds the 33rd position on U.S. News & World Report’s “Best States” ranking.

- Education spending: Nevada allocated $11,677 per student in 2022, ranking among the lowest quartile in the U.S.

- Infrastructure: In 2018, Nevada received a “C” grade from the American Society of Civil Engineers (ASCE), with no updated evaluation as of 2024.

- Healthcare spending: While Nevada’s healthcare costs were $6,714 per capita in 2014—the lowest among states with no income tax—spending increased to $8,348 per capita in 2020, now ranking as the third lowest nationally.

Tax Structure in Nevada

- Income tax: None

- Sales tax: 6.85% (can exceed 8% in some areas)

- Property tax: Moderate

4. South Dakota

Total Tax Burden: 6.44% (7th Lowest in the U.S.)

Key Benefits: No personal or corporate income tax, low cost of living

Downsides: Harsh winters, rural economy

South Dakota maintains its no-income-tax policy by generating revenue from high sales taxes, property taxes, and taxes on cigarettes and alcohol. The state is also home to major credit card companies, further bolstering its economy. As a result, South Dakotans pay just 6.44% of their personal income in taxes, ranking 7th lowest nationwide.

South Dakota is one of the most affordable states, ranking 5th in affordability and 11th on U.S. News & World Report’s “Best States” list.

- Healthcare spending: In 2014, South Dakota ranked 14th in the nation, with healthcare costs at $8,933 per capita. By 2020, spending increased to $12,495 per capita, placing the state 8th highest in the U.S.

- Education spending: The state allocated $11,564 per student in 2022, the lowest among Midwestern states.

- Infrastructure: While South Dakota has not received an official ASCE rating, 17% of bridges were rated structurally deficient in 2021, and 90 dams were deemed high hazard potential.

Despite lower taxes, infrastructure concerns remain a challenge for South Dakota. However, affordability and business-friendly policies continue to make it a desirable place to live.

Tax Structure in South Dakota

- Income tax: None

- Sales tax: 4.5%

- Property tax: Higher than the national average

5. Texas

Total Tax Burden: 7.56% (14th Lowest in the U.S.)

Key Benefits: No state income tax, strong economy, booming job market

Downsides: High property taxes, increasing housing costs

Texas is one of the few states where state income taxes are unconstitutional. However, to fund infrastructure and public services, the state relies heavily on sales and excise taxes.

- Sales tax: Can reach 8.25% in some jurisdictions.

- Property taxes: Among the highest in the country.

- Total tax burden: 7.56% of personal income, ranking 14th lowest nationwide.

Despite its relatively low tax burden, Texas ranks 28th in affordability, making it an average-cost state. It also sits at 29th on U.S. News & World Report’s “Best States” list.

- Education spending: $11,803 per student in 2022.

- Infrastructure: Received a C grade from ASCE in 2021.

- Healthcare spending: $6,998 per capita in 2014 (7th lowest in the U.S.), rising to $8,406 per capita in 2020 (4th lowest).

Tax Advantage: Texans benefit from the $10,000 cap on state and local tax (SALT) deductions imposed by the Tax Cuts and Jobs Act, as it has a smaller impact compared to residents in high-tax states like California and New York.

Tax Structure in Texas

- Income tax: None

- Sales tax: 6.25% (up to 8.25% with local taxes)

- Property tax: High

6. Washington

Total Tax Burden: 8.04% (22nd Lowest in the U.S.)

Key Benefits: No personal income tax, strong tech-driven economy

Downsides: High cost of living, state-imposed capital gains tax

Washington boasts a young population (only 15.9% of residents are over 65) and attracts major businesses due to no state-mandated corporate income tax. However, high-income earners are subject to a state capital gains tax.

While Washingtonians avoid income tax, they face high sales and excise taxes, making gasoline prices among the highest in the U.S.. As a result, the state’s total tax burden is 8.04%, ranking 22nd lowest.

- Affordability: Ranks 47th, making it one of the most expensive states to live in.

- Quality of Life: Ranked 8th on U.S. News & World Report’s “Best States” list.

Public Spending in Washington

- Healthcare: $7,913 per capita in 2014, slightly below the national average. By 2020, it increased to $9,265 per capita, ranking 40th.

- Education: Spent $17,119 per student in 2022, among the highest in the country.

- Infrastructure: Earned a C grade from ASCE in 2019.

Despite high living costs, Washington remains an attractive state due to its business-friendly environment and strong economy.

Tax Structure in Washington

- Income tax: None (except for capital gains)

- Sales tax: 6.5% (up to 10.4% in some cities)

- Property tax: Moderate

7. Wyoming

Total Tax Burden: 5.70% (6th Lowest in the U.S.)

Key Benefits: No personal or corporate income tax, low population density

Downsides: Harsh winters, limited job market

With only six people per square mile, Wyoming is the second least densely populated state, behind only Alaska.

Wyoming offers major tax advantages, including:

- No personal or corporate state income tax

- No retirement income tax

- Low sales tax rates

Despite these low taxes, Wyoming generates revenue from natural resource taxes, primarily from the oil industry. The state’s total tax burden—which includes property, income, sales, and excise taxes—is just 5.70% of personal income, ranking 6th lowest nationwide.

- Affordability ranking: 19th in the U.S.

- Best States ranking: 12th by U.S. News & World Report

Public Spending in Wyoming

- Education: $18,529 per student in 2021, among the highest in the nation and double that of neighboring Idaho.

- Healthcare: $10,989 per capita in 2020, reflecting strong healthcare investment.

- Infrastructure: Received a C grade from ASCE in 2023.

Wyoming’s low taxes and high per capita spending on essential services make it a desirable state for residents seeking financial advantages.

Tax Structure in Wyoming

- Income tax: None

- Sales tax: 4% (up to 6% with local taxes)

- Property tax: Low

8. Tennessee

Total Tax Burden: 6.07% (5th Lowest in the U.S.)

Key Benefits: No state income tax on wages, growing economy

Downsides: High sales tax, increasing cost of living

Before 2016, Tennessee taxed investment income (dividends and interest), but not wages. However, a 2016 tax reform plan gradually reduced investment income taxes by 1% per year, with full elimination by 2021.

With no personal income tax, Tennessee has become an attractive destination for retirees who rely on investment income.

- Total tax burden: 6.07%, ranking 5th lowest in the U.S.

- Affordability ranking: 18th in the U.S.

- Best States ranking: 27th by U.S. News & World Report

Public Spending in Tennessee

- Education: $11,317 per student in 2022, placing it toward the lower end nationally.

- Healthcare: $9,336 per capita in 2020, also among the lowest in the country.

- Infrastructure: Received a C grade from ASCE.

Despite low education and healthcare spending, Tennessee remains an affordable state with a business-friendly tax structure.

Tax Structure in Tennessee

- Income tax: None

- Sales tax: 7% (up to 9.75% with local taxes)

- Property tax: Low to moderate

9. New Hampshire

Total Tax Burden: 5.63% (2nd Lowest in the U.S.)

Key Benefits: No tax on wages or salaries

Downsides: Taxes on dividends and interest, high property taxes

New Hampshire stands out for having no earned income tax. However, investment income (dividends and interest) is taxed, though legislation has been passed to phase it out by 1% per year until full elimination by 2027.

- No state sales tax, though excise taxes apply (e.g., on alcohol).

- High property taxes: 1.86% of property value, 3rd highest in the nation.

Despite high property taxes, New Hampshire’s total tax burden is only 5.63%, making it the 2nd lowest nationwide.

- Best States ranking: 2nd by U.S. News & World Report

- Affordability ranking: 44th in the U.S. (high living costs)

Public Spending in New Hampshire

- Education: $21,605 per student in 2022, among the highest in the U.S.

- Healthcare: $11,793 per capita in 2020, ranking 12th highest nationwide.

- Infrastructure: Received a C- grade from ASCE in 2017.

While New Hampshire has high property taxes and living costs, its low overall tax burden and strong public spending make it a top-ranked state for quality of life.

Tax Structure in New Hampshire

- Income tax: None on wages (4% on dividends/interest)

- Sales tax: None

- Property tax: High

Pros and cons of living in a state with no income taxes

Here’s a balanced look at the pros and cons of living in a state with no income taxes:

Pros

- More Take-Home Pay

You keep more of your paycheck, especially if you’re a high earner. - Simpler Tax Filing

No need to file a separate state income tax return-less paperwork and stress. - Attracts Residents and Businesses

These states often attract new residents and entrepreneurs, potentially boosting job opportunities. - Financial Flexibility

You might find it easier to save or invest with fewer taxes taken from your income.

Cons

- Higher Sales and Property Taxes

To make up for the lost income tax revenue, states often raise other taxes, like sales or property taxes. - Less Funding for Public Services

Schools, infrastructure, and healthcare might be underfunded compared to higher-tax states. - Cost of Living May Still Be High

States like Florida and Washington might not have income tax, but housing and daily expenses can still be expensive. - Not Always Better for Low-Income Families

Without income tax brackets, the tax burden might shift unfairly toward lower-income residents via consumption-based taxes.

In short, living in a state with no income tax can mean more money in your pocket and simpler tax filing, but it often comes with trade-offs like higher costs elsewhere and potential cuts to public services. It’s important to look beyond just the income tax rate and consider the full financial picture before deciding if it’s the right move for you.

Overview of Retirement Tax Friendliness

Retirement tax friendliness refers to how gently a state taxes retirees, including income from Social Security, pensions, and retirement accounts. States like Florida, Nevada, and Tennessee are considered very tax-friendly since they have no income tax. Others, like Pennsylvania, exempt all retirement income.

On the flip side, states like California and Minnesota may tax retirement income more heavily. Overall, tax-friendly states can help retirees stretch their savings and enjoy a more financially comfortable retirement.

FAQs about States Without Income Tax

1. Which States Have No State Income Tax?

Nine U.S. states do not impose a state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming

However, Washington does impose a state capital gains tax on certain high-income earners.

2. Why Do States Impose Taxes?

After the adoption of the U.S. Constitution, the federal government gained the authority to impose taxes, while individual states retained the right to levy their own taxes—as long as they comply with both the U.S. Constitution and their own state constitutions.

States generate revenue through:

- Income taxes (if applicable)

- Sales and excise taxes

- Property taxes

- Fees and licenses

This tax revenue helps fund essential services, including education, infrastructure, and public safety.

3. Which States Don’t Tax Retirement Distributions?

A total of 13 states do not tax retirement distributions, including 401(k) plans, IRAs, and pensions.

- States That Fully Exempt Retirement Distributions: These states do not tax retirement distributions from 401(k) plans, IRAs, or pensions: Illinois, Mississippi, Pennsylvania

- States With No State Income Tax: These states do not impose any state income tax, meaning retirement income is automatically tax-free: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming

- States That Exempt Pensions but Tax 401(k) and IRA Distributions: Alabama, Hawaii

Retirement Tax Breaks in Other States

Even in states that tax retirement income, some offer deductions for retirees:

- Colorado: Taxpayers 55+ can deduct up to $20,000 in retirement income; those 65+ can deduct up to $24,000.

- Georgia: Taxpayers 62+ can exclude up to $35,000; those 65+ can exclude up to $65,000.

4. Which States Tax Social Security Benefits?

Only 10 U.S. states tax Social Security benefits: Colorado, Connecticut, Kansas, Minnesota, Montana, New Mexico, Rhode Island, Utah, Vermont, West Virginia

5. Does Florida Have a State Income Tax?

No, Florida does not impose a state income tax. Florida is one of nine states with no state income tax, alongside:

- Alaska

- Nevada

- South Dakota

- Tennessee

- Texas

- Wyoming

However, Washington and New Hampshire do tax investment income, but not wages.

Florida’s tax-friendly policies make it an attractive destination for retirees and businesses.

6. Which States with the highest and lowest effective tax rates for retirees?

As of 2025, Oregon has the highest effective tax rate on retirees drawing $100,000 from an IRA – about 20.4% for single filers. In contrast, Georgia offers the lowest for married couples at around 7.8%, while New Jersey is lowest for single filers at 13.9%. These rates reflect both tax levels and retirement income deductions, showing how state taxes can significantly affect retirees’ finances.

Conclusion: Should You Move to a No-Income-Tax State?

Relocating to a state with no income tax can provide significant financial benefits, but it’s essential to consider the full tax picture. Many states compensate with higher sales and property taxes, and factors such as cost of living, job opportunities, and quality of life should also be taken into account.

If you’re looking for a low-tax environment, states like Texas, Florida, and Tennessee offer business-friendly policies, while Wyoming and South Dakota provide a more rural, low-cost lifestyle.

Before making a move, consult a tax professional to evaluate how these changes will impact your financial situation.