Payroll Outsourcing

Outsource your payroll to our in-country experts.

Streamline your payroll with accurate, compliant, and hassle-free outsourcing services—tailored to businesses of all sizes. Let us handle your payroll, so you can focus on growing your business.

Book free consultation

Fill out the form below, and we'll arrange a consultation at a time most suitable for you.

Why Choose Payroll Outsourcing?

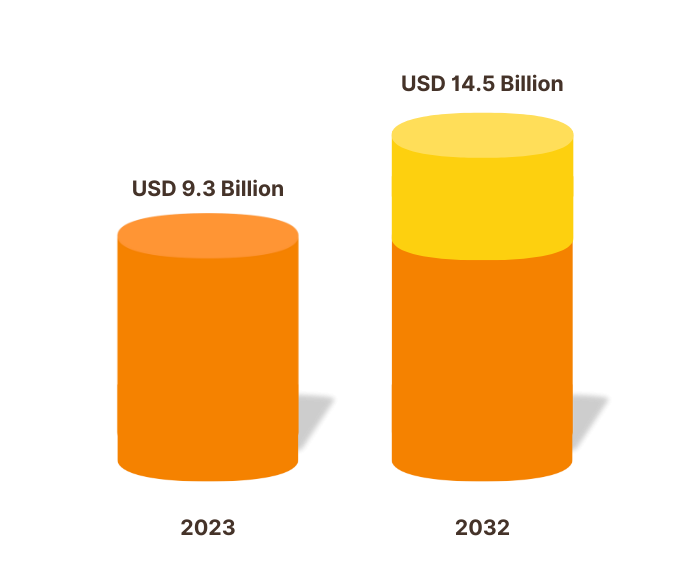

The payroll outsourcing industry is booming, with the global market size reaching $9.3 billion in 2023 and projected to grow to $14.5 billion by 2032 at a CAGR of 5.06%.

Stay ahead by partnering with a trusted provider, freeing up your time to focus on delivering exceptional service to your clients!

Payroll Outsourcing Market Report 2024-2032

Overwhelmed by Your Clients’ Payroll Needs?

Are you struggling with the complexities of managing payroll for your clients, including:

- Safeguarding sensitive data

- Accurately calculating payroll taxes

- Ensuring precise payments

- Managing timely payroll distribution?

If so, you’re in the right place!

Let our team of payroll outsourcing experts handle it all for you, ensuring a smooth and stress-free experience throughout your client’s payroll process.

By outsourcing payroll, CPA firms avoid the expenses of hiring and maintaining a dedicated payroll team. This includes savings on salaries, benefits, software, and infrastructure. External payroll providers often offer scalable pricing models, making it a cost-effective solution.

Payroll processing involves complying with tax laws, labor regulations, and reporting requirements that are constantly evolving. Outsourcing payroll ensures that firms remain compliant with all federal, state, and local regulations, minimizing the risk of costly fines and legal issues.

Professional payroll providers specialize in handling payroll with precision. They use automated systems to calculate payroll taxes, deductions, and benefits, reducing the chance of human errors that can lead to tax penalties or employee dissatisfaction.

Payroll service providers are experts in the latest payroll regulations, tax laws, and technologies. CPA firms benefit from their in-depth knowledge and ability to navigate complex payroll processes, ensuring the firm remains compliant and up-to-date.

Payroll data includes sensitive information such as employee wages, benefits, and personal details. Outsourcing to a reputable provider ensures that this information is protected using advanced security measures, reducing the risk of data breaches or fraud.

CPA firms that outsource payroll can offer payroll management as an additional service to their clients. This can expand the firm’s service offerings and create a more holistic approach to managing their clients' financial needs.

Accurate and timely payroll processing is essential for maintaining employee satisfaction. Outsourcing ensures employees are paid on time and correctly, improving morale and reducing payroll-related grievances.

As a CPA firm grows or experiences seasonal fluctuations, its payroll needs may change. Outsourced payroll services can easily scale to meet the firm’s requirements without the need to hire additional staff or invest in new systems.

Scalable payroll services that grow with your business.

Leverage Our Automation Software

Streamline your payroll with our fully integrated automation software, which automates data entry, reduces errors, and minimizes effort.

Seamless Implementation

Our payroll experts manage every step of your implementation, ensuring a smooth transition from start to finish when you outsource your payroll.

Expert Support

Receive ongoing guidance and support from our HR and Legal teams, available to assist you both during and after implementation.

Achieve huge success with our expertise

Complete payroll services

Flexible and scalable payroll outsourcing solutions.

Make managing your payroll painless with the help of our experienced payroll & labour professionals. Our online-managed payroll services include:

- Payroll Processing

- Processing Employee Benefits

- Support in Worker Compensation Audit

- Providing Management Reports

- Payroll Tax Reporting & Filing

- 1099 form preparation

We manage payroll processing,

so you don’t have to

Marketing solutions

Trusted payroll provider to hundreds of CPA firms.

As a trusted partner for hundreds of CPA firms, we deliver reliable and efficient payroll solutions tailored to your unique needs. Our comprehensive services ensure compliance with evolving regulations, minimize errors, and enhance data security, all while streamlining payroll processes.

With our expert support and state-of-the-art technology, CPA firms can focus on their core financial services, knowing their payroll is in capable hands. Let us handle the complexities, so you can provide top-tier service to your clients.

Quality Assurance

We have implemented robust quality control processes at every stage of our operations. From data collection and entry to financial analysis and reporting, our internal review mechanisms ensure that all tasks are thoroughly reviewed for accuracy and completeness. This ensures that any errors or discrepancies are identified and rectified promptly. We are committed to delivering the highest standard of service to our clients, ensuring accuracy, reliability, and compliance in all aspects of our accounting outsourcing services

We evaluate the quality according to the ISO 9001:2015. We have the experience and expertise to deliver quality output on time.

We guard and protect your private information and keep it from the public’s eye.

Our Benefits

Why Choose Bestarion for Finance and Accounting Services

When you work with Bestarion you get a team of finance experts who take the work off your plate–so you can focus on your business.

We've got answers

Frequently asked questions

If you're new or looking for answers to your questions, this guide will help you learn more about our services and their features.

Payroll outsourcing involves hiring a third-party provider to manage and process payroll tasks, including wage calculations, tax filing, benefits management, and direct deposits.

Reputable payroll providers use advanced encryption and security measures to protect sensitive employee and financial data, ensuring compliance with data protection regulations.

We offer two pricing models: an hourly rate and a value-based rate, depending on the exact nature of your payroll. To request a custom quote, fill out the form at the bottom of this page or take a look at our price list here.

Payroll outsourcing typically includes wage calculations, tax withholdings, direct deposits, benefits administration, payroll reporting, tax filings, and compliance monitoring.

Look for a provider with experience, strong data security measures, compliance expertise, and customizable services to fit your business needs. Checking reviews and getting recommendations can also help in the decision-making process.

Yes, Bestarion offers customizable services to fit the specific needs of your business, allowing you to outsource as much or as little of your payroll functions as needed.

Start Your Project Today and Watch Business Grow

Get in Touch

Our Advantages

21+ years of providing software solutions development services for global businesses.

5+ years of providing accounting outsourcing services for CPA firms in the US.

215+ released projects

180+ in-house specialists

Needs analysis instead of sales talk

Valuable suggestions from experts in the field for your project.

Vietnam

QTSC Building 1, Street 14, Quang Trung Software City, Tan Chanh Hiep Ward, District 12, HCM City, Vietnam