5 Tips for CPAs to Improve Peak Tax Season Productivity

Tax season is the busiest time for accounting businesses in the United States. CPAs are hurrying to complete tasks, battling tight deadlines, and usually keeping one eye on the clock and the other on the computer. Even though CPAs and EAs are extremely busy throughout tax season, they always leave the impression that they could have done much better. This is a major reason why many accounting companies are outsourcing tax preparation to solve their tax season productivity issues.

Productivity is a long-standing issue. Unfortunately, accounting companies have been dealing with this issue using old techniques such as ad-hoc/temporary recruiting, working overtime, ad-hoc ignorant technology integration, etc.

Read more: Tax Outsourcing Helps Retain and Acquire New Clients in Tax Season

Let’s look at a few methods and approaches for accounting firms to boost their productivity:

5 Tips to Improve Peak Tax Season Productivity

1. Start Planning Before The Tax Season Begins

We are not endowed with foresight, so the next best thing is to go out there and ask some questions about how much work you expect to get during tax season. How much work do you expect your firm to receive during tax season? The answer to this question will help you plan more effectively. But let’s dig a little deeper into this subject. Consider whether you want to continue with your current clients or go for new ones. Consider gaining more work from your current clientele. Inquire with your clients about the possibility of them referring extra tax preparation work to your firm in the middle or at the end of the tax season.

The information you obtain at this step will tell you whether you have the resources to handle all of the work that is expected of you and, more crucially, whether all of the work you are aware of is sufficient. If not, you can devise a strategy for acquiring new clients and employees.

2. Concentrate on Process Improvement

You are selling your skills as an accounting firm, but it doesn’t mean you shouldn’t have systems to offer that expertise to your clients. A series of critical procedures occur between when the client submits their financial papers and when you file their tax returns.

The process is made up of these steps. Consider whether your processes are holding your firm back or are optimally configured well before tax season begins. The ideal strategy here is to evaluate the time each step takes and pinpoint the issue. For example, if you request preliminary financial information from a client, do you receive it all at once or in pieces? Do certain clients need to be repeatedly reminded to send in the required information? Consider this time while determining process efficiency and deliverability goals.

3. Address Your Staffing Issues

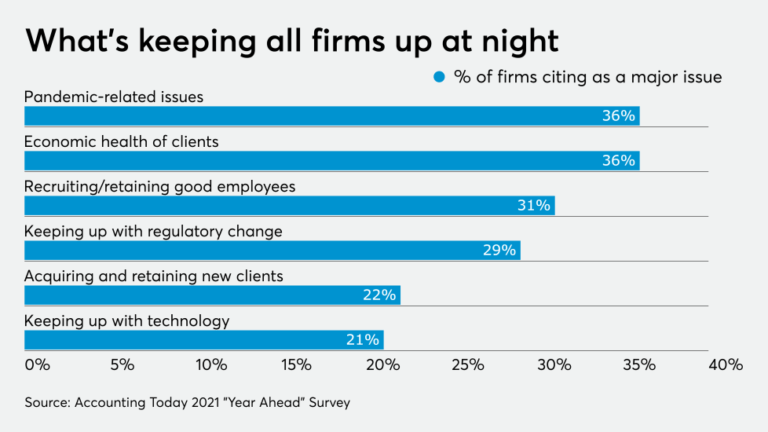

Accounting professionals are in short supply in the sector. This means proper staffing throughout tax season is necessary if you want to improve your production. But do you have a pool of accountants and tax preparers from whom to choose just for tax season? It’s crucial to realize that other businesses will think along the same lines. The skill pool is small, and a supply and demand imbalance exists.

A big difficulty for 31% of businesses is finding and maintaining good staff. It might also become a huge concern for you, so do you have a plan to avoid a resource shortage? You don’t want to be in a scenario where clients are willing to send you tax preparation work, but you need more resources to handle it. Outsourced accountants are commonly used by businesses to solve personnel issues. However, this should be a timely remedy. This brings us to the following point.

4. External Resourcing is an Answer

Outsourcing or external resourcing is one method for ensuring that your company grows quickly and, if necessary, that you can scale down your organization.

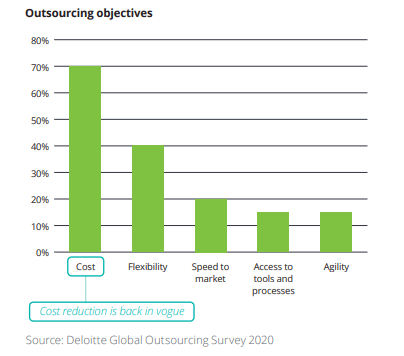

According to Deloitte, cost is the most common reason for organizations to outsource. While this is a significant benefit, and outsourced accounting companies save significant money, CPA businesses must also consider outsourcing from a scalability standpoint.

Look for an outsourced partner who specializes in US tax and accounting regulations. Examine their accountants’ skill sets, knowledge, and the engagement models they provide. Check if their engagement methods align with your needs, and request client references. Talk to their customers to determine the quality of their services.

But that’s not the end of the story. Make certain you understand the software they use and their delivery-center infrastructure. It must be of the highest quality, as should their communication system. Also, ensure that they have a BCP plan that allows them to deliver work without interruption, regardless of the situation.

Accounting outsourcing in India is quite popular because many outsourced service providers can handle your needs. The goal here is to conduct extensive market research to identify the service supplier that best suits your requirements.

Something you should pay attention to in your search for the best accounting outsourcing provider is the accounting outsourcing India services provider’s data security posture. In the United States, you should ideally engage with a SOC 2 Type II compliant organization with all of the security processes to ensure data protection and privacy.

Read more: Tax Preparation Outsourcing Service Provider: 10 Key Qualities

5. Customer Orientation Always

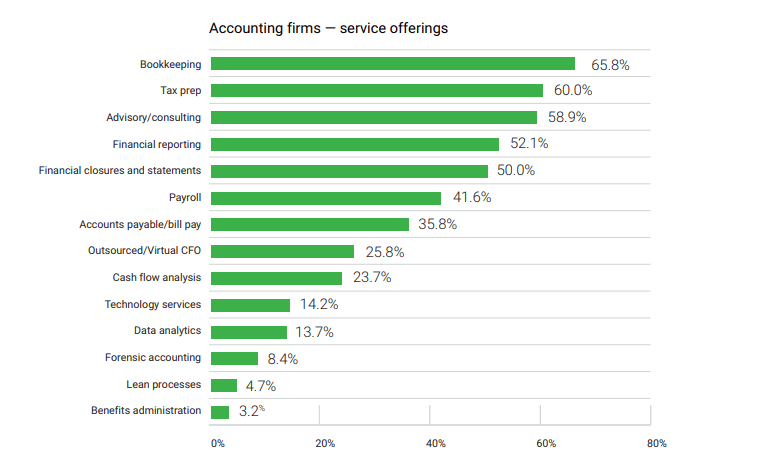

54% of buyers always purchase bundled accounting services. As a result, they choose to work with a firm that provides bookkeeping services and tax preparation.

To scale your business, you must take a strategic strategy. Scale your services not because your competitors are doing so but because the market is urging you to. Looking at the graph above, you can see that 41.6% of businesses provide payroll services. What if you are one of the firms that do not provide payroll services but have a prospective client who wants a packaged package that includes tax preparation (your specialty) and payroll processing? You might lose that customer.

If a few additional clients need payroll services and tax preparation, you’ll understand that you need to expand your offering and scale properly. Scaling with consumer demand in mind can ensure you get the desired results.

This is an example of informed scalability. This enables you to make decisions knowing there is a market demand for a specific service, and thus, you must add more resources (more productivity) specializing in that particular service, or you know there is a significant number of potential clients looking for a set of services that you do not offer.

Your selection will have an immediate impact on your productivity. Scalability and productivity should work in tandem to generate the ROI you seek.

Read more: Outsourcing Tax Preparation: Pros & Cons

Conclusion

Rapid productivity increases are only achievable if you partner with a firm that provides tax preparation outsourcing for accounting companies. However, remember that the shift to outsourcing should be linked to your scalability goals.