Get an Instant Cost

Calculate Your Accounting Outsourcing Cost Savings

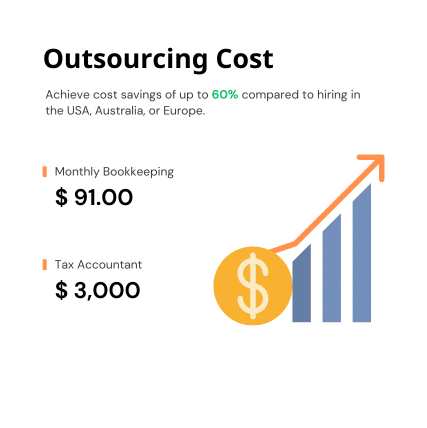

Save up to 60% on staffing costs for CPA firms while accessing top-notch bookkeeping and accounting expertise—fast, reliable, and cost-effective!

See How Much You Can Save

Interactive Cost Estimator

We can help you estimate your potential cost savings when outsourcing your accounting tasks to us compared to the in-house costs in the U.S. Bestarion's rates vary based on the volume of work and task complexity. Contact us today for a customized pricing proposal tailored to your needs.

Select Engagement Models

Select at least one service to begin. Please note that the bookkeeping rates provided are an estimate and are subject to confirmation upon verification of the information provided.

Select Services

Select at least one service to begin. Please note that the bookkeeping rates provided are an estimate and are subject to confirmation upon verification of the information provided.

Monthly Bookkeeping

Enter the number of your clients corresponding to each Average of Monthly Transactions tier below.

For example, if you have 2 clients with <50 transactions per month, enter '2' in the '<50' row.

| Tier | Average of Monthly Transactions | Number of Monthly Clients | Bestarion Rate (Monthly) |

|---|---|---|---|

| 01 | < 50 | $0 | |

| 02 | < 100 | $0 | |

| 03 | < 200 | $0 | |

| 04 | < 300 | $0 | |

| 05 | < 500 | $0 | |

| 06 | < 800 | $0 | |

| 07 | < 1000 | $0 | |

| 08 | 1000 - 2000 | $0 | |

| 09 | 2000 - 3000 | $0 | |

| If the average of monthly transactions is more than 3,000 please contact us via email for a tailored quote to meet your needs. | |||

| TOTAL COST | $0 | $0 | |

This price apply for Bookkeeping Basic Package, included:

Add-On Services (Optional)

For add-on services, we will provide a quotation based on the scope of work, with charges calculated per hour for each service. Contact us via email so we can provide a tailored quote for your business.

Payroll

Enter the number of your clients corresponding to each No.of Employees tier below.

For example, if you have 2 clients with <50 transactions per month, enter '2' in the '<50' row.

| Tier | No.of Employees | Number of Monthly Clients | Bestarion Rate (Monthly) |

|---|---|---|---|

| 01 | <= 5 | $0 | |

| 02 | <= 10 | $0 | |

| 03 | <= 20 | $0 | |

| 04 | <= 30 | $0 | |

| If the number of employees is more than 30, please contact us via email for a tailored quote to meet your needs. | |||

| TOTAL COST | $0 | $0 | |

This price apply for Payroll Basic Package, included:

Add-On Services (Optional)

For add-on services, we will provide a quotation based on the scope of work, with charges calculated per hour for each service. Contact us via email so we can provide a tailored quote for your business.

Please Enter the Number of Headcount You Need for Each Position

| Position | Number of Headcount | In-House (USA) | Current Costs (Monthly) | Bestarion Rate (Monthly) |

|---|---|---|---|---|

| Data Entry Operator |

|

$17.93 | $0 | $0 |

| If you need a headcount of less than a whole number like 0.5, 1.5, or 3.5, please contact us via email for a tailored quote to meet your needs. | ||||

| Accounting Supervisor |

|

$34.00 | $0 | $0 |

| If you need a headcount of less than a whole number like 0.5, 1.5, or 3.5, please contact us via email for a tailored quote to meet your needs. | ||||

| Payroll Specialist |

|

$23.05 | $0 | $0 |

| If you need a headcount of less than a whole number like 0.5, 1.5, or 3.5, please contact us via email for a tailored quote to meet your needs. | ||||

| Tax Accountant |

|

$34.00 | $0 | $0 |

| If you need a headcount of less than a whole number like 0.5, 1.5, or 3.5, please contact us via email for a tailored quote to meet your needs. | ||||

| Total Monthly Labor Cost | 0 | $0 | $0 | |

|

Hiring an in-house accountant comes with overhead costs for office space, equipment, and supplies. Below, we have estimated the annual non-labor costs per employee based on the US market. |

||||

| Payroll Taxes (10-12%) | $7,000 - $10,800 | Included in Agent Costs | ||

| Employee Benefits (20-30%) | $14,000 - $27,000 | Included in Agent Costs | ||

| Office Space, Equipment, & Utilities | $5,000 - $15,000 | Included in Agent Costs | ||

| Accounting Software & Tools | $1,500 - $10,000 | Included in Agent Costs | ||

| Training & Compliance | $2,000 - $5,000 | Included in Agent Costs | ||

| HR, Legal, & Other Admin Costs | $2,000 - $6,000 | Included in Agent Costs | ||

| Total Annual Non-Labor Cost Per Employee | $31,500 - $73,800 | 0 | ||

| Total Monthly Non-Labor Cost Per Employee | $2,625 - $6,150 | 0 | ||

| TOTAL MONTHLY COST PER EMPLOYEE | $2,625 - $6,150 | $0 | ||

|

Outsourcing your accounting tasks to us can save you: 40% - 43% |

Total Summary

Grand total: $0.00

This price does not include the cost of add-on services. Please contact us via email for a tailored quote for your business.

Saving 100% compared to in-house costs.

This is not the final price. We can adjust it according to your requirements and our mutual agreement.

Not sure about the quote?

Schedule your free consultations here.Why Outsource Accounting with Bestarion?

-

25-37% Productivity Boost in just one month!

-

Cut Costs & Scale Easily without extra overhead.

-

Accurate, Compliant, & Seamless Integration with your systems.

Industry Insights

Cost Comparison: In-House Accountant vs. Outsourced Accounting Services

Hiring an in-house accountant vs. using an outsourced accounting firm can have significant cost differences depending on business size, service needs, and industry. Below is a detailed comparison:

In-House Accountant Costs

Hiring a full-time accountant includes salary and non-labor costs such as benefits, payroll taxes, software, office space, training, etc.

| Expense Category | Estimated Annual Cost |

|---|---|

| Base Salary | $70,000 – $90,000 (mid-level) |

| Payroll Taxes (10-12%) | $7,000 – $10,800 |

| Employee Benefits (20-30%) | $14,000 – $27,000 |

| Office Space, Equipment, & Utilities | $5,000 – $15,000 |

| Software & Tools (QuickBooks, ERP, etc.) | $1,500 – $10,000 |

| Training & Compliance | $2,000 – $5,000 |

| HR, Legal, & Other Admin Costs | $2,000 – $6,000 |

| Total Annual Cost (Mid-Level Accountant) | $101,500 – $163,800 |

Key Considerations for In-House Hiring

- Full-time control over accounting operations.

- Required for large businesses with complex financial needs.

- Higher fixed costs (benefits, office, payroll taxes).

- Time-consuming recruitment & onboarding process.

- Risk of turnover, requiring replacement & retraining costs.

Outsourced Accounting Costs

Instead of hiring full-time, businesses can outsource accounting services for a fraction of the cost.

| Service Level | Estimated Monthly Cost | Estimated Annual Cost |

|---|---|---|

| Basic Bookkeeping (Small business, <100 transactions/month) | $300 – $800 | $3,600 – $9,600 |

| Standard Accounting (Payroll, tax filing, reporting) | $1,500 – $3,000 | $18,000 – $36,000 |

| Full-Service CFO Support (Strategic financial planning) | $4,000 – $8,000 | $48,000 – $96,000 |

Key Benefits of Outsourcing Accounting

- Cost Savings: Save 40-60% compared to hiring in-house.

- Scalability: Adjust services as your business grows.

- Access to Expertise: Work with CPAs, tax specialists, and financial analysts.

- No Payroll Taxes or Benefits.

- Avoid Training & Compliance Headaches.

- 24/7 Service Availability (depends on provider).

Cost Savings: In-House vs. Outsourced Accounting

| Accounting Option | Annual Cost |

|---|---|

| In-House Accountant | $101,500 – $163,800 |

| Outsourced (Standard Accounting) | $18,000 – $36,000 |

| Estimated Savings | $65,000 – $140,000 per year |

Businesses can cut costs by 40-60% by outsourcing accounting instead of hiring full-time.

When to Choose In-House vs. Outsourcing?

| Factor | In-House Accountant | Outsourced Accounting |

|---|---|---|

| Business Size | Large companies ($10M+ revenue) | Small-Mid businesses |

| Accounting Complexity | Advanced (M&A, Tax Strategy, IPO) | Standard (Bookkeeping, Payroll, Compliance) |

| Cost Sensitivity | High Fixed Costs (Salary, Benefits) | Cost-Effective, Flexible Pricing |

| Control Needed | Full-time presence required | Works remotely but accessible |

| Scalability | Fixed overhead | Easily scales with business |

Final Recommendation

- Outsourcing accounting is a cost-effective solution for most small & medium businesses that need bookkeeping, payroll, and tax filing without the high costs of full-time hiring.

- Companies that require strategic CFO services or frequent financial analysis may still benefit from a hybrid approach—outsourcing bookkeeping/payroll while keeping a finance director in-house.