Revenue Cycle Analytics: What It Is & How it Benefits RCM

In today’s complex healthcare landscape, managing the revenue cycle efficiently is more critical than ever. Revenue Cycle Analytics transforms raw financial and operational data into actionable insights – helping providers improve cash flow, reduce denials, and optimize billing accuracy. This guide explores what Revenue Cycle Analytics is, how it strengthens Revenue Cycle Management (RCM), and the best practices to implement it effectively for sustainable financial performance.

Key Takeaways:

- Revenue Cycle Analytics turns complex data into actionable insights that improve cash flow, billing efficiency, and revenue capture.

- Accurate data, clear KPIs, and seamless integration are essential for successful implementation.

- Analytics reduces denials, supports compliance, and enhances decision-making, driving measurable financial improvements.

- Ongoing refinement and staff engagement ensure long-term sustainability and maximum ROI.

What is Revenue Cycle Analytics?

Revenue Cycle Analytics is the practice of using data analysis, reporting, and business intelligence tools to evaluate and improve the revenue cycle in healthcare.

The revenue cycle covers all the financial processes involved in a patient’s journey – from scheduling and registration to insurance verification, service delivery, billing, claims submission, payment posting, and collections. Because this cycle directly impacts a provider’s cash flow, profitability, and operational efficiency, analyzing it in detail is essential.

With Revenue Cycle Analytics, healthcare organizations can monitor key performance indicators (KPIs) such as denial rates, days in accounts receivable, charge capture accuracy, and net collection rates. These insights help providers quickly spot bottlenecks, reduce claim rejections, and prevent revenue leakage.

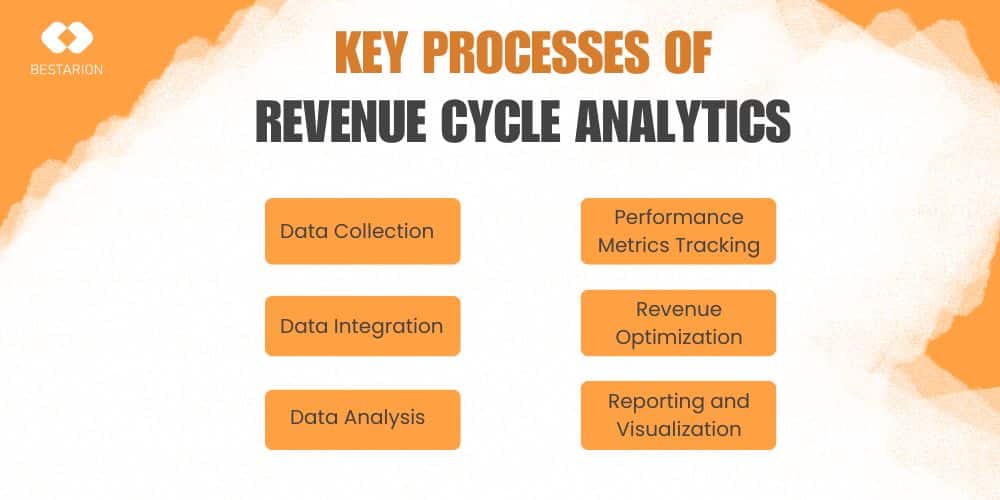

Key Processes of Revenue Cycle Analytics

To fully realize the benefits of Revenue Cycle Analytics, healthcare organizations must follow a structured set of processes that transform raw financial and operational data into meaningful insights. Each process plays a critical role in ensuring that data is accurate, integrated, and analyzed effectively to drive better financial outcomes.

From collecting and unifying data across multiple systems to analyzing trends and tracking performance metrics, these processes create a clear picture of the revenue cycle. They not only reveal inefficiencies and areas for improvement but also provide actionable insights for optimizing revenue and improving cash flow. Finally, with reporting and visualization, leaders gain accessible, easy-to-understand information to make informed, data-driven decisions.

Data Collection

- Gather data from multiple sources such as Electronic Health Records (EHR), billing systems, claims management platforms, and patient payment portals.

- Ensure accuracy and completeness of information including patient demographics, insurance details, coding, and payment history.

Data Integration

- Combine data from different systems into a unified platform for a complete view of the revenue cycle.

- Standardize formats and remove duplicates or errors to ensure consistency across all datasets.

Data Analysis

- Apply analytical methods and business intelligence tools to identify patterns, inefficiencies, and revenue leakage points.

- Use predictive analytics to forecast payment trends, denial risks, and cash flow projections.

Performance Metrics Tracking

- Monitor KPIs such as denial rates, Days in Accounts Receivable (A/R), net collection rate, and clean claim rate.

- Establish benchmarks to compare performance against industry standards or internal goals.

Revenue Optimization

- Identify opportunities to improve charge capture, reduce denials, and accelerate payment posting.

- Implement corrective actions such as staff training, process redesign, or automation tools to maximize revenue.

Reporting and Visualization

- Present insights through dashboards, scorecards, and visual reports that make complex data easy to understand.

- Provide leadership teams with actionable information to support strategic decision-making.

Together, these processes form the backbone of Revenue Cycle Analytics, enabling healthcare providers to gain a clear view of their financial operations, reduce inefficiencies, and improve overall revenue cycle performance.

How Revenue Cycle Analytics Benefits RCM

Revenue Cycle Analytics is more than just a tool for tracking financial data – it is a strategic approach that directly enhances the effectiveness of Revenue Cycle Management (RCM). By turning complex financial and operational information into actionable insights, analytics helps healthcare providers uncover inefficiencies, improve accuracy, and maximize revenue opportunities across the entire patient journey.

Improved Revenue Capture

Analytics helps identify missed charges, underpayments, and billing errors, ensuring providers capture the full value of services delivered. This reduces revenue leakage and maximizes reimbursement potential.

Enhanced Claims Processing

By analyzing claim submission patterns and payer requirements, healthcare organizations can improve claim accuracy and speed up approvals. This minimizes delays and accelerates cash flow.

Reduced Denial Rates

Advanced analytics highlights common reasons for claim denials and predicts which claims are at risk. With these insights, providers can address issues proactively, lowering denial rates and improving first-pass resolution.

Increased Patient Payment Collections

Revenue Cycle Analytics provides visibility into patient payment trends and balances. This allows providers to design better collection strategies, offer transparent billing, and improve the likelihood of on-time payments.

Streamlined Billing Operations

Data-driven insights help standardize billing workflows, reduce redundancies, and identify process inefficiencies. This leads to faster billing cycles and fewer manual errors.

Data-Driven Decision-Making

With access to dashboards and real-time reports, leadership teams can base decisions on evidence rather than assumptions. This supports more effective resource allocation, staffing, and financial planning.

Compliance Monitoring

Analytics tools can track regulatory requirements and highlight potential compliance risks. This ensures billing and coding practices meet legal and payer standards, reducing the risk of audits or penalties.

Enhanced Financial Performance Analysis

By consolidating financial data and tracking key performance indicators, providers gain a comprehensive view of their revenue cycle health. This enables ongoing performance improvement and long-term financial sustainability.

Revenue Cycle Analytics empowers healthcare organizations to capture more revenue, reduce denials, streamline billing, and improve collections. By enabling compliance and data-driven decision-making, it strengthens both financial performance and patient experience – making it a critical tool for modern Revenue Cycle Management.

Common Challenges in Implementing Revenue Cycle Analytics

Understanding these common challenges is the first step toward overcoming them. By recognizing potential barriers early, healthcare organizations can develop strategies to address them proactively and ensure that Revenue Cycle Analytics delivers its intended value – improving financial performance, operational efficiency, and patient satisfaction.

- Data Silos and Fragmentation: Many healthcare organizations use multiple, disconnected systems for billing, EHR, and claims, making it difficult to unify and analyze data effectively.

- Poor Data Quality: Incomplete, inaccurate, or duplicate records reduce the reliability of analytics and lead to flawed insights.

- Limited Technical Expertise: Implementing advanced analytics tools requires skilled staff in data management and business intelligence—resources that some organizations may lack.

- High Implementation Costs: Investing in data platforms, software, and training can be costly, especially for smaller practices with limited budgets.

- Change Management Resistance: Staff may be hesitant to adopt new processes or rely on analytics-driven decision-making, slowing down implementation efforts.

- Regulatory and Compliance Concerns: Ensuring that analytics processes align with HIPAA, payer requirements, and other healthcare regulations can be complex and time-consuming.

- Difficulty in Defining Metrics: Without clear KPIs and benchmarks, it becomes challenging to measure success or identify areas needing improvement.

- Integration with Existing Workflows: Analytics must fit seamlessly into current billing and clinical workflows—otherwise, it risks creating additional burdens rather than efficiencies.

Most Significant Revenue Cycle Analytics KPIs

Here are some of the most significant revenue cycle analytics KPIs:

- Days in Accounts Receivable (A/R): Indicates how quickly a healthcare provider collects payments, serving as a key measure of cash flow efficiency.

- Clean Claim Rate: Tracks the percentage of claims submitted without errors on the first attempt, reflecting the accuracy of billing and coding processes.

- Denial Rate: Measures the proportion of claims rejected by payers, highlighting issues in documentation, eligibility, or coding.

- Net Collection Rate: Shows the effectiveness of revenue collection after adjustments and contractual write-offs, offering a realistic view of financial performance.

- First Pass Resolution Rate (FPRR): Reflects the percentage of claims resolved and paid upon first submission, demonstrating the strength of front-end processes.

- Cost to Collect: Calculates the administrative cost of collecting revenue, helping organizations assess operational efficiency and resource allocation.

Best Practices for Implementing Revenue Cycle Analytics Effectively

Implementing Revenue Cycle Analytics can deliver transformative results for healthcare organizations, but success depends on more than just having the right tools. Without a structured approach, even the most advanced analytics systems may fail to provide meaningful insights or drive measurable improvements.

- Establish Clear Goals and KPIs: Define the specific objectives you want to achieve with analytics- such as reducing denials, improving cash flow, or enhancing patient collections – and align them with measurable KPIs.

- Ensure Data Accuracy and Consistency: Clean, validate, and standardize data from all sources to build a reliable foundation for analysis. Inaccurate data will lead to misleading insights.

- Invest in the Right Technology: Choose analytics platforms and tools that integrate seamlessly with EHRs, billing, and claims systems to provide a unified view of the revenue cycle.

- Leverage Automation and Dashboards: Use automated reporting, real-time dashboards, and visualization tools to make insights accessible and actionable for both leadership and staff.

- Train and Engage Staff: Provide training to billing, coding, and finance teams on how to interpret analytics and apply findings in their daily workflows. Encourage a culture of data-driven decision-making.

- Monitor Compliance and Security: Ensure that analytics practices adhere to regulations such as HIPAA while maintaining strict data privacy and security protocols.

- Adopt Continuous Improvement: Treat Revenue Cycle Analytics as an ongoing process. Regularly review metrics, update strategies, and adjust to industry changes or payer requirements.

Frequently Asked Questions About Revenue Cycle Analytics

1.What is revenue cycle analytics, and how does it differ from traditional revenue cycle management?

Revenue Cycle Analytics uses data analysis and reporting to evaluate and optimize the healthcare revenue cycle, turning financial data into insights that improve efficiency and maximize revenue. Traditional Revenue Cycle Management (RCM) focuses on the operational tasks – like billing, claims submission, and collections- that keep payments moving. The difference: RCM manages the process, while Revenue Cycle Analytics improves the process by identifying trends, bottlenecks, and opportunities for growth.

2. How much can healthcare organizations expect to save by implementing revenue cycle analytics?

Healthcare organizations can save substantially with Revenue Cycle Analytics, often seeing a 3 -5% revenue lift, 20 – 30% fewer denials, and 10 – 20% faster cash flow. For mid- to large-sized hospitals, this can mean millions in annual savings through improved efficiency and revenue capture.

3. What are the most important metrics to track in revenue cycle analytics?

The most important metrics in revenue cycle analytics include Clean Claim Rate, Denial Rate, Days in AR, Net Collection Rate, First Pass Resolution Rate, Cost to Collect, Patient Payment Collection Rate, and Bad Debt Rate. These KPIs help organizations monitor efficiency, reduce revenue leakage, and improve overall financial health.

4. How long does it typically take to implement revenue cycle analytics?

The implementation of revenue cycle analytics typically takes 3 to 6 months, depending on the size of the organization, complexity of existing systems, and level of data integration required. Larger healthcare systems with multiple platforms may take longer, while smaller practices with streamlined operations can implement more quickly.

5. Can small healthcare practices benefit from revenue cycle analytics?

Yes – small healthcare practices can absolutely benefit from revenue cycle analytics. By leveraging data insights, they can reduce claim denials, speed up reimbursements, improve cash flow, and identify inefficiencies in billing. Even on a smaller scale, analytics helps optimize revenue capture and ensures financial stability without requiring large teams or resources.